French startup Qonto has raised a $23 million funding round for its fintech product. The company is trying to make business banking cheaper, faster and more efficient.

Existing investors Valar Ventures and Alven are once again leading the round. The European Investment Bank Group is also participating.

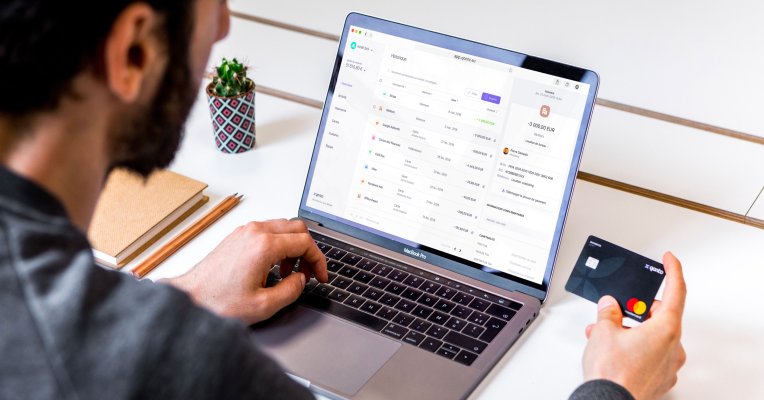

If you are running a small company or work as a freelancer, Qonto wants to replace your professional bank account. When you sign up, you get a French IBAN, one or multiple debit cards and the ability to send and receive money.

And then, it works pretty much like any challenger bank. You can create virtual cards, order more cards for your team, get real time notifications and freeze cards. This is a breath of fresh air compared to traditional business banks and their time-consuming processes.

You can then sync your transactions with accounting and invoicing services, and grant access to your accountant. Premium plans let you select multiple administrators and create a validation workflow to approve expensive transfers for instance.

With today’s funding round, the company plans to double the size of the team and create its own payment infrastructure. Qonto currently relies heavily on Treezor for the back end. The startup also plans to expand to Germany, Italy and Spain in 2019.

Qonto now has 90 employees and 25,000 clients. The company has managed $2 billion in total transaction volume so far. The fact that the same VC funds keep investing more money into Qonto is a great vote of confidence.