French startup Upflow has raised a $2.7 million funding round (€2.5 million) from Kima Ventures, eFounders and various business angels. The company tracks your outstanding invoices and makes sure you get paid on time.

If you’re running a small company, chances are you’re using Excel spreadsheets to enter invoice information, check your company’s bank account every day and manually tag invoices that have been paid.

Microsoft Excel has been such a powerful tool for so many different use cases that plenty of startups are trying to replace it — I call this phenomenon The Great Unbundling of Excel. And Upflow is one of those startups.

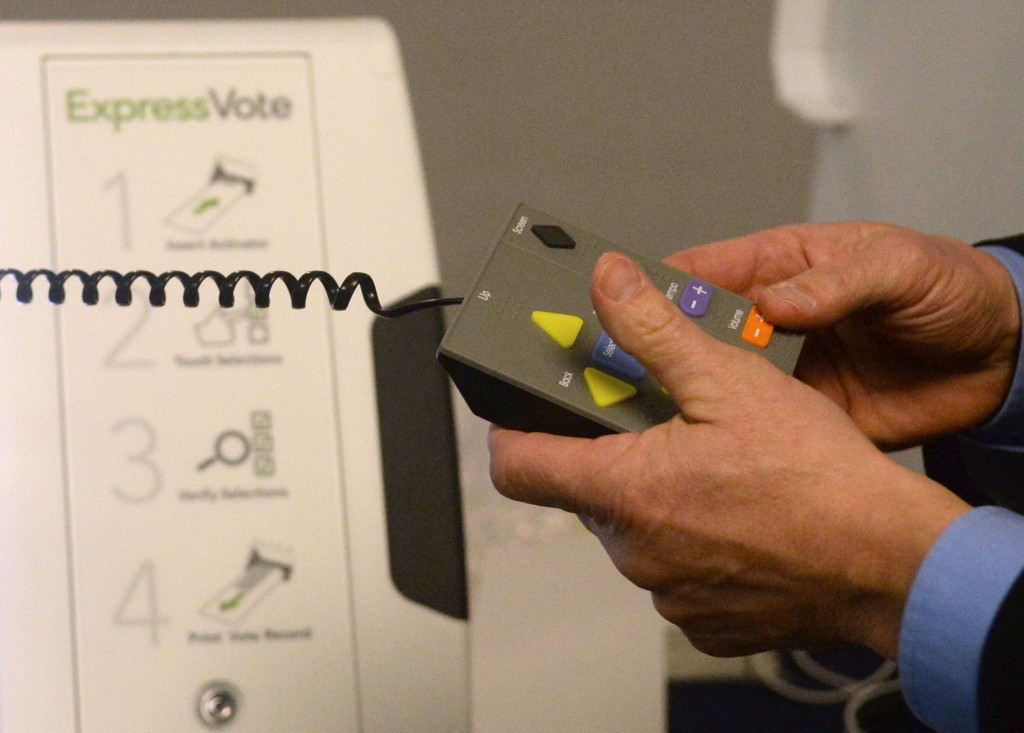

If you want to replace a system that works well, you need to make it radically better. In order to do that, Upflow has created a payment brick that sits between your bank account and your customers.

Every time you send an invoice, you can write an email from the Upflow interface so that the entire sales team is on the same page. Making this experience collaborative with a software-as-a-service approach is already a big improvement over Excel spreadsheets.

Your invoice features banking information for your Upflow account. When your customer transfers the money, Upflow can instantly mark an invoice as paid. The startup transfers money back to your company’s bank account every day.

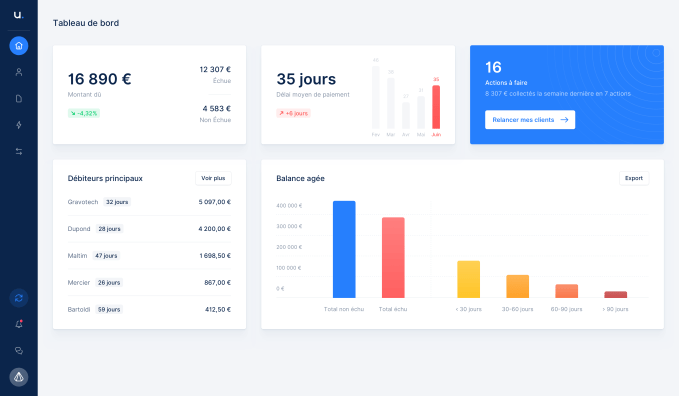

Over time, you get insights about your recurring customers, you can see how much money your clients collectively owe you and you can send reminders to late clients.

If you want to read more about Upflow, you can read my profile of the company.