California was the only state to get its risk grade lowered in a Wall Street credit-quality watcher’s latest scoring of U.S. housing markets.

After looking at 2019’s third quarter stats, Fitch Ratings found the state’s housing prices, up 4.1% in a year, as “sustainable” — that’s the mid-range score between “overvalued” and “undervalued.” Fitch tracks various real estate and economic metrics to gauge if the underlying fundamentals can support house prices in individual markets.

California joins 28 other states at this risk level. The state was ranked 5%-to-9% “overvalued” three months earlier and in 2018’s third quarter.

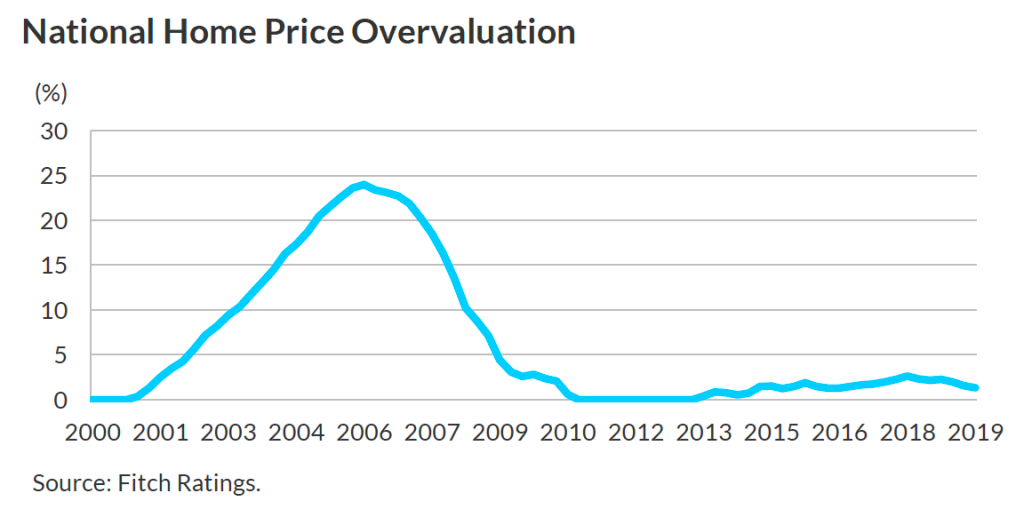

Nationally, Fitch estimates U.S. home prices were 1.3% overvalued in 2019’s third quarter after rising 3.7% in the previous 12 months. The U.S. market was calculated by Fitch to be more than 20% overvalued before real estate’s bubble burst in the late 2000s.

Fitch notes last year’s national appreciation is down from it’s 6%-a-year pace since 2012 and “prices in most regions appear to be valued in line with long-term sustainable levels.”

Still, four states were found to have rising risks in the latest quarter studied by Fitch:

North Dakota: As prices rose 3.5% in a year, it was graded as 15%-to-19% “overvalued” vs. 10%-to-14% “overvalued” three months earlier.

Arizona: Prices up 7.9% in a year; ranked 10%-to-14% “overvalued” vs. 5%-to-9% “overvalued” three months earlier.

Tennessee: Prices up 6.2% in a year; ranked 5%-to-9% “overvalued” vs. “sustainable” three months earlier.

Maine: Prices up 8% in a year; was ranked “sustainable” for “undervalued” three months earlier.

Other highly overvalued states in the quarter, with gradings unchanged, were: Idaho (prices up 11.6% in a year) and Nevada (up 4.9%) at 20%-to-24% “overvalued;” and Texas (up 4.9%) at 10%-to-14% “overvalued.”

Lowest risk or “undervalued” states? Massachusetts, Maryland, New Hampshire, Connecticut, Illinois, Michigan and New Jersey.

Fitch’s math, when applied to 20 big U.S. metro areas, found the three California markets tracked as “sustainable” and stable: Los Angeles-Orange County (up 1.7%); San Diego (up 3%); and San Francisco (down 0.5%).

Most overvalued metro? Las Vegas, up 2.6% in a year, at 20%-to-24% “overvalued.”

Nationwide, Fitch sees rents rising as fast as home prices as key support for home values, with Fitch’s thinking the thin national overvaluation level is headed to zero this year if current trends continue.

“The cost to buy a home will look increasingly more attractive relative to renting over time,’ said Grant Bailey, a Fitch managing director.