With turmoil in financial markets pushing many key interest rates to record lows, why are mortgage rates going … higher?

The economic damage from the global coronavirus outbreak has freaked out financial markets and caused most interest rates to plummet.

However, this week real estate saw a hiccup. What should have been an added boon to the real estate market, even cheaper mortgages, didn’t materialize. The “savings” that lenders are potentially reaping from cheaper sources of money don’t appear to be fully passed along to consumers.

On one hand, it’s hard for a borrower, purchasing a home or refinancing an old loan, to complain about today’s near record-low rates. The average 30-year, fixed-rate mortgage was 3.36% this week, up from a record low 3.29% a week earlier.

Still, I’ll argue they should be cheaper. Look at the key benchmark of mortgage-making cost, yields on the 10-year U.S. Treasury bond. By one key measure, it was a stunningly low 0.54% on Thursday, March 12 — almost half of 0.96% a week ago.

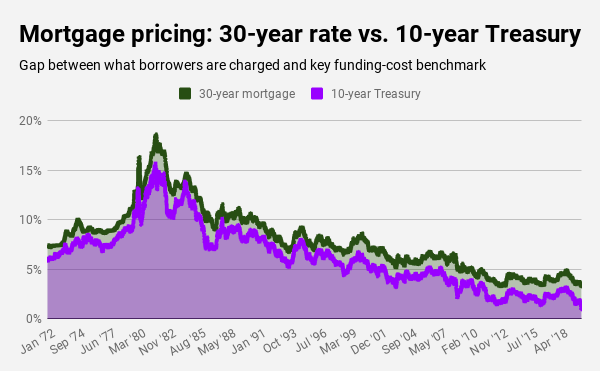

The gap between what lenders are charging and what the bond market is saying is historically wide. When I put into my trusty spreadsheet a half-century’s worth of rate data, I found this week’s gap between these two key interest rates — what’s loosely a big part of mortgage-making profit — at 2.82 percentage points.

How big is that? It’s the largest gap in 12 years. Since 1972 — years that included numerous periods of double-digit mortgage rates — this gap has been wider only 4% the time. And over 48 years, this spread between mortgage rates and Treasury yields has averaged 1.7 percentage points.

So, simply put, if these were average times, my spreadsheet tells me mortgage rates should be more like 2.24% — or more than a full point below current quotes.

“Somehow, someway, mortgage rates actually moved higher this week, touching their highest level in almost a month despite immense volatility in the markets and Treasury yields falling and remaining near all-time lows,” wrote Zillow Economist Matthew Speakman. “So, what’s the deal?”

Here’s the bond-market market logic, translated into English as best I can.

Let’s remember that mortgage rates are actually set in large part by big-dollar institutional investors who buy packages of home loans from lenders. One of these investors’ biggest risks is not foreclosures. Rather it’s buying loans that might quickly be refinanced.

Mortgage rates were falling well before anyone knew what coronavirus was and that drop started a huge wave of refinancings. Please recall that average home-loan rates were above 4% from early 2018 through May 2019. Recently rate drops only exploded the urge to refi.

One argument is this recent unusually wide mortgage-to-Treasury gap may be an attempt by investors to cool the refinancing boom.

Why? When a loan is repaid, the investor does get their money back. But when rates are down, the investors’ financial pain is that they then must reinvest at lower yields. So investors’ motivation to get higher rates, always part of their pricing equation, is amplified.

Or perhaps the wide mortgage-Treasury gap also reflects the huge uncertainty created by market volatility. Basically, investors don’t want to be “stuck” owning underpriced loans if a broad chunk of interest rates quickly reverse and soar higher.

Ponder the last time we saw this large of a gap between mortgage rates and 10-year Treasurys. It was the 2008 financial crisis when investors of all sorts couldn’t figure out the future. And before that market meltdown, big gaps were previously found in 2000-2002 during the dot-com bubble-bursting market turmoil.

Of course, there’s a chance some greed is involved here, too. Consumers may be happy with the savings created by a new refi, but this pricing gap suggests the public should being saving even more.

Now, hopefully the mortgage investment market is big enough that if Treasury rates stay depressed, some investors (and, thus, lenders) will see opportunity in pushing mortgage rates even lower. That might make this fat gap history.

But no matter the cause or length of this pricing gap, extraordinary cheap mortgages should be a powerful boost to the housing market. Well, assuming house hunters don’t lose jobs or income due to the coronavirus fallout.

Look at these estimates from Meyers Research. In Los Angeles and Orange counties, the drop from 4% mortgages to 3.25% is equal to a $64,000 price cut on a home and brings a typical monthly payment back to 2014 levels. In Riverside and San Bernardino counties, it’s a $31,500 savings, bringing payments back to 2015 levels.

Imagine if mortgage prices catch up to the current ultra-cheap cost of money.

We are providing free access to this article. Please consider supporting local journalism like this by subscribing here.