Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

Most tech companies base compensation on an employee’s local cost of living, in addition to their skills and responsibilities. The pandemic-era push to remote work seems to be reinforcing that — if you only skim the headlines. For example, Facebook said last week that it would be readjusting salaries for employees who have relocated away from the Bay Area.

But Connie Loizos caught up with a few well-placed people who see something else happening. First, here’s Matt Mullenweg, CEO of Automattic (WordPress), which has been almost entirely remote for its long and successful history.

“Long term, I think market forces and the mobility of talent will force employers to stop discriminating on the basis of geography for geographically agnostic roles,” he told Connie for TechCrunch.

Mullenweg went on to detail how the process was still complicated, and that his company did not yet have a universal approach. But ultimately, he thinks that for “moral and competitive reasons, companies will move toward globally fair compensation over time with roles that can be done from anywhere.”

Connie also talked to Jon Holman, a tech recruiter who is living and breathing the new world, in a separate article for Extra Crunch. The market forces will ultimately favor talent, he concurs, and companies that want talent will pay according to what they can afford. “If a good AI or machine learning engineer is working elsewhere and demand for those skills still exceeds supply,” Holman explained, “and his or her company pays less than for the same job in Palo Alto, then that person is just going to jump to another company in his or her own geography.”

Taking stock of the future of retail

Our weekly staff survey for Extra Crunch is about retail — will it exist? how? A few of our staffers who cover related topics weighed in:

-

Natasha Mascarenhas says retailers will need to find new ways to sell aspirational products — and what was once cringe-worthy might now be considered innovative.

-

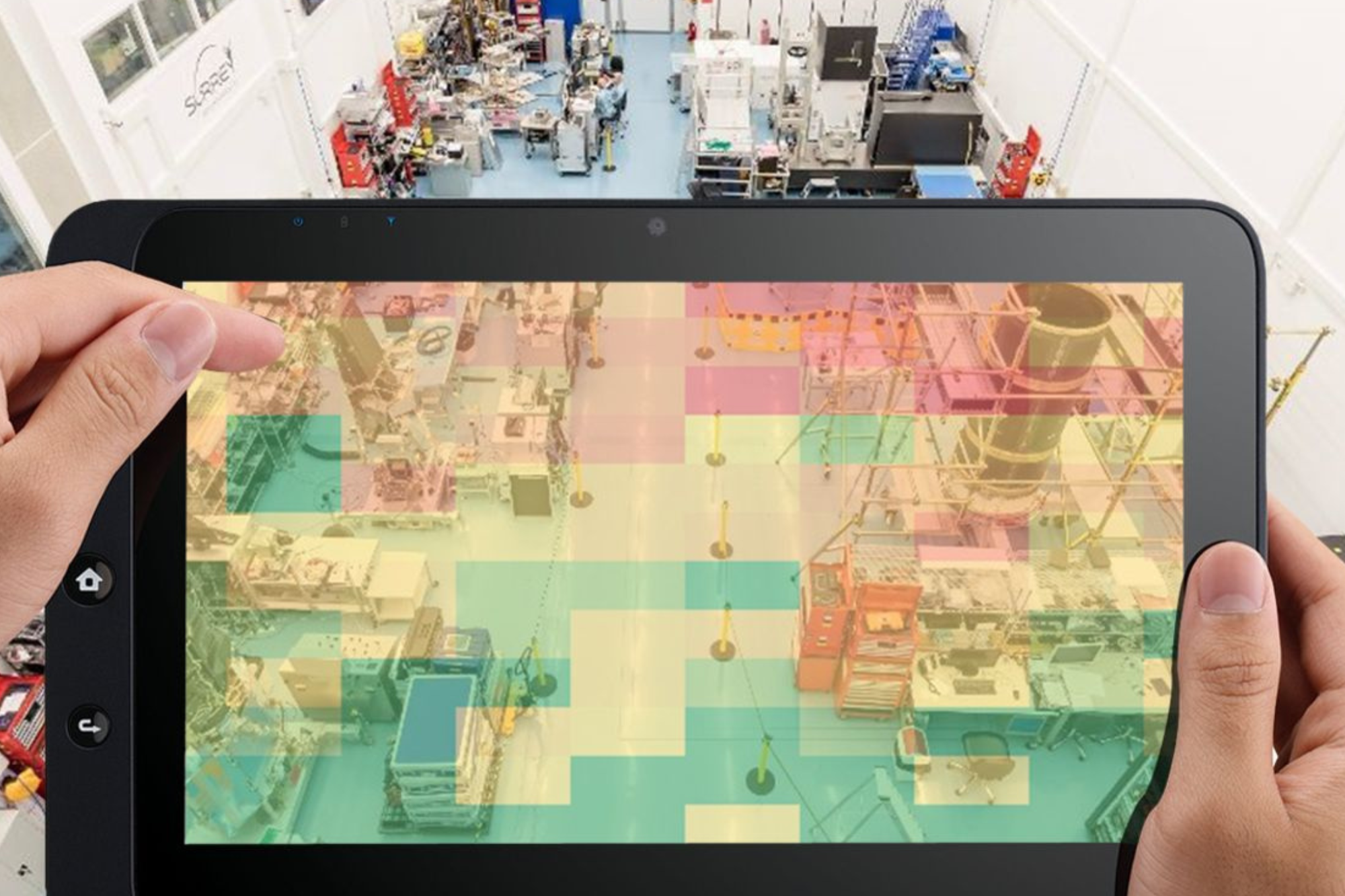

Devin Coldewey sees businesses adopting a slew of creative digital services to prepare for the future and empower them without Amazon’s platform.

-

Greg Kumparak thinks the delivery and curbside pickup trends will move from pandemic-essentials to everyday occurrences. He thinks that retailers will need to find new ways to appeal to consumers in a “shopping-by-proxy” world.

-

Lucas Matney views a revitalized interest in technology around the checkout process, as retailers look for ways to make the purchasing experience more seamless (and less high-touch).

We also ran two investor surveys this week, with Matt Burns producing one on manufacturing and Megan Rose Dickey and Kirsten Korosec following up on their autonomous vehicles series.

How to think about strategic investors (in a pandemic)

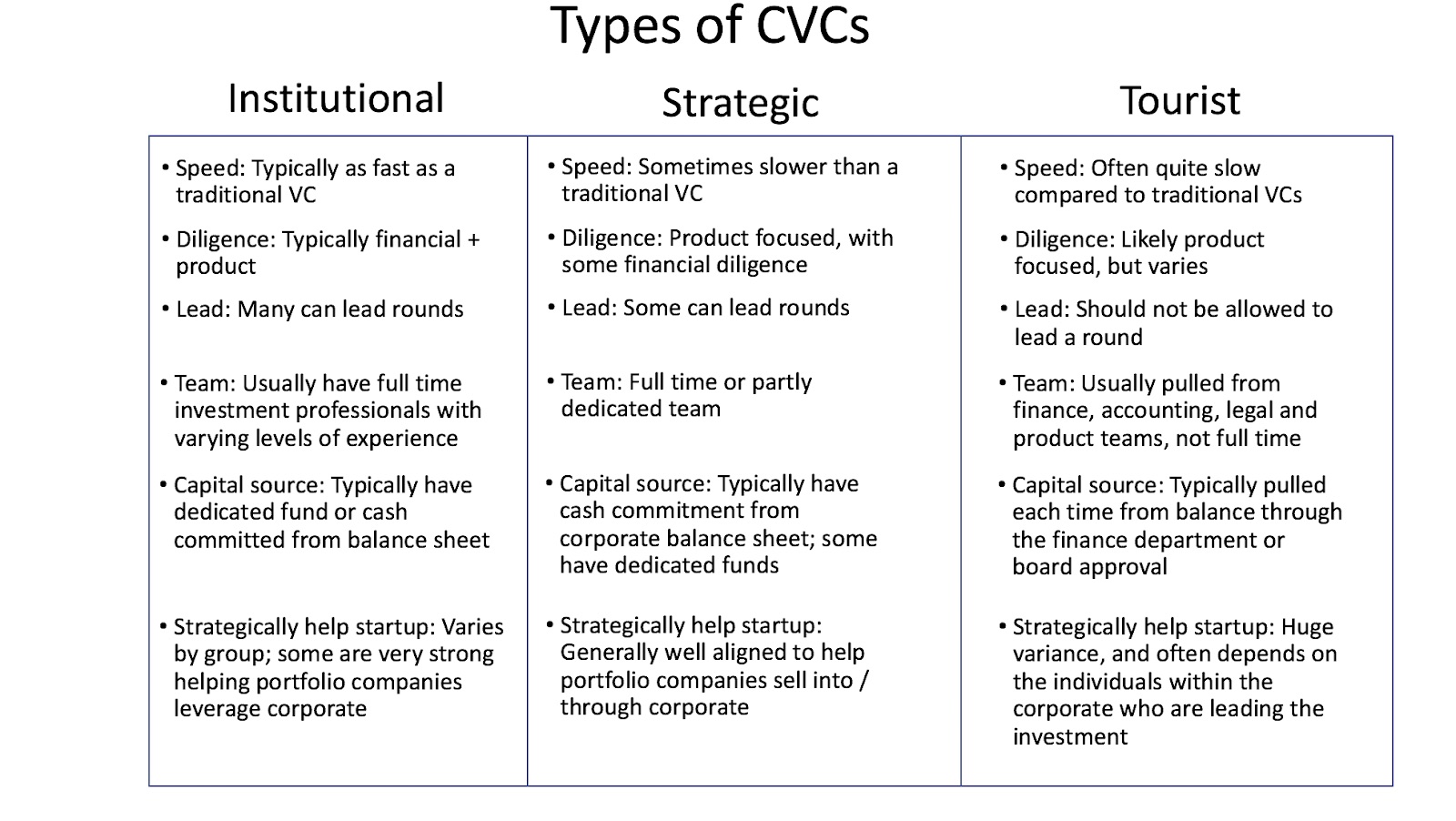

Maybe you could use some more money, distribution and partnerships these days? Those are the eternal lures of corporate venture funding sources, but each strategic VC has a different mandate. Some are there to help the parent company, some are just there to make money… and some may be on thin ice themselves given the way that they get money to invest.

If you’re taking a fresh look at getting strategic funding now, check out this set of overview articles from Bill Growney, a partner at top tech law firm Goodwin, and Scott Orn of Kruze Consulting. The first, for TechCrunch, goes over how corporate funds are typically structured (and motivated). The second, for Extra Crunch, covers questions for startup founders to anticipate and other recommendations for dealing with this type of VC.

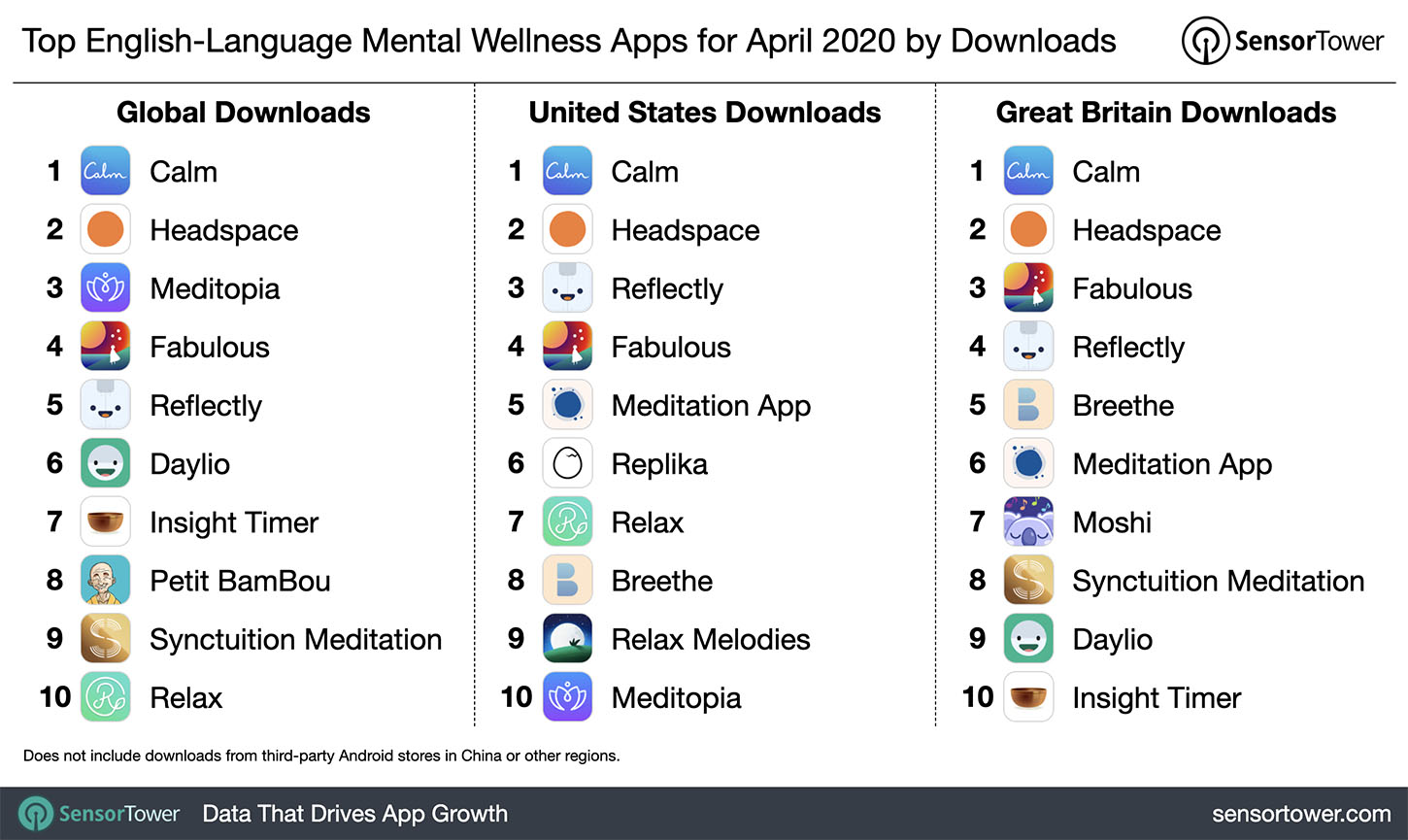

Calm chooses a more enlightened path to growth

It is high times for meditation and “mindfulness” apps, as people look for ways to adjust to pandemic life. Sarah Perez, our resident app expert, took a look at a new app store analysis on TechCrunch, shredded some of the top-ranked companies for opportunistic marketing, and came away with a positive feeling about the global market leader.

Calm, meanwhile, took a different approach. It launched a page of free resources, but instead focused on partnerships to expand free access to more users, while also growing its business. Earlier this month, nonprofit health system Kaiser Permanente announced it was making the Calm app’s Premium subscription free for its members, for example — the first health system to do so.

The company’s decision to not pursue as many free giveaways meant it may have missed the easy boost from press coverage. However, it may be a better long-term strategy as it sets up Calm for distribution partnerships that could continue beyond the immediate COVID-19 crisis.

Mindfulness pays. On that note, subscribers can read her excellent This Week In Apps report every Saturday over on Extra Crunch.

Around TechCrunch

TechCrunch’s Early Stage, Mobility and Space events will be virtual, too

Win a Wild Card to compete in Startup Battlefield at Disrupt 2020

Join GGV’s Hans Tung and Jeff Richards for a live Q&A: June 4 at 3:30 pm EDT/12:30 pm PD

Across the week

TechCrunch

AI can battle coronavirus, but privacy shouldn’t be a casualty

Living and working in a worsening world

How to upgrade your at-home videoconference setup: Lighting edition

Equity Morning: Remote work startup fundings galore, plus a major court decision

Extra Crunch

API startups are so hot right now

Investors say emerging multiverses are the future of entertainment

Dear Sophie: Can I work in the US on a dependent spouse visa?

Fintech regulations in Latin America could fuel growth or freeze out startups

The secret to trustworthy data strategy

#EquityPod

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines. This week’s show took a break from regularly scheduled programming. Our co-host Alex Wilhelm, who usually leads us through the show, was on some much-deserved vacation, so Danny Crichton and Natasha Mascarenhas took the reigns and invited Floodgate Capital’s Iris Choi to join in on the fun. It’s Choi’s fourth time being on the podcast, which officially makes her our most tenured guest yet (in case the accomplished investor needs another bullet point on her bio page).

This week’s docket features scrappiness, a seed round and a Startup Battlefield alumnus.

Here’s what we chewed through:

- LeverEdge raised seed funding to get you and your friends a volume discount on student loans. Fintech has been booming for years now, and startups often crop up around the painful world of student loans. Yet this startup still caught our eye, and it has a little something to do with its choice to use collective bargaining power as its modus operandi.

- Stackin’ raised a $12.6 million Series B for a text-messaging service that connects millennials to money tips, and eventually other fintech apps. According to CEO Scott Grimes, Stackin’ wants to be the “pipes that port people around fintech.” We get into if the world needs a fintech app marketplace and how it targets younger users.

- D-ID, a Startup Battlefield alumnus, digitally de-identifies faces in videos and still images and just raised $13.5 million. We’re all worried about our privacy concerns, so the funding news was a refreshing change of pace from the usual headlines we see around surveillance. Now the company just needs to find a successful use case beyond the goodness in people’s hearts.

- ByteDance, the Chinese parent company that owns TikTok, hit $3 billion in net profit last year, reports Bloomberg. TikTok also recently snagged former Disney executive Kevin Mayer for its CEO. This one, as you can expect, made for an interesting conversation around privacy and bandwidth. We even asked Choi to weigh in on Donald J. Trump’s recent tweet threatening to regulate social media companies, as Floodgate was an early angel investor in Twitter.

- We ended with a roundtable of sorts on how the future of work will look and feel in our new world, from college campuses to offices. We get into the vulnerability that comes with being on Zoom, the ever-increasing stupidity of “manels” and how tech talent might be flocking to smaller cities but investors aren’t just yet.

And that was the show! Thanks to our producer Chris Gates for helping us put this together, thanks to you all for listening in on this quirky episode and thanks to Iris Choi for always bringing a fresh, candid perspective. Talk next week.