Cleo, the London founded “financial assistant” that takes the form of an app and chatbot and now counts the U.S. as its largest market, has raised $44 million in Series B funding.

Leading the round, which I understand actually closed earlier this year, is EQT Ventures. Also participating are existing investors Balderton Capital, LocalGlobe and SBI.

They join much earlier investors such as Entrepreneur First, Taavet Hinrikus, Matt Robinson, Errol Damelin, Niklas Zennstrom, Alex Chesterman, and Ian Hogarth — all well-known names in London’s tech investment community.

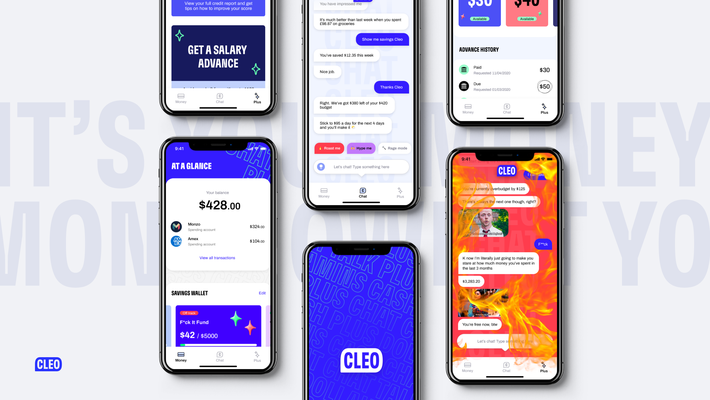

Targeting “Gen Z” and with a rather lofty sounding mission to “fight for the world’s financial health,” Cleo’s AI/machine learning-powered app connects to your bank accounts and gives you proactive advice and information on your finances, including timely nudges, to help you stay on top of your spending. Over time, the idea is that Cleo can help change your financial behaviour for the better.

The broader premise is that Cleo can replace your bank’s own app, and by speaking to you in a more human and user-friendly way, improve your financial health. In addition, and crucially — as Cleo founder Barney Hussey-Yeo is fond of arguing — the company can do all of this without having the same cost base or misaligned incentives of an actual bank.

The assumption made in 2017, when Cleo really got off the ground, was that through a combination of data science and machine learning, delivered in a fun and openly gamified way, the company’s financial assistant chatbot could attract and retain gen z and millennial users. Then, after engaging with the app, users would have experienced enough value to upgrade to a paid subscription or various financial services offered through Cleo now or in the future. With 4 million registered users — 96 percent of whom are in the U.S. — the first part appears to be panning out.

Hussey-Yeo tells me the new funding round gives him a “mandate” to take some big product bets in order to move forward the financial health of Cleo’s users. “[Those product bets] won’t all work out, but if one or two of them connects, we’ll fundamentally change the game in some of the most broken areas in financial services”.

In addition, the company will expand its operations in the U.S., including building out executive and product teams in San Francisco.

“When we launched in the U.S it became quickly apparent that it would be our dominant market,” says the Cleo founder. “We were signing up about 1,000 users per day in the U.K. at the time. After [just] a week, we were at 10,000 per day in the U.S. and kept growing”.

Hussey-Yeo attributes a lot of the success state-side to better banking APIs in the U.S. with Plaid, which he says “dramatically drove up” conversion rates and lowered customer acquisition costs. “This combined with a much larger market focused us 100% on winning in the U.S. first. This race is far from played out”.

Hussey-Yeo says Cleo will always offer a free version “because everybody needs the ability to make smarter decisions about their financial lives”. In contrast, the premium product costs $5.99 per month and is intended for people who “need a little extra help,” providing features such as gamified savings, and “levelled up” credit scores with coaching. Premium users can also trigger a $100 salary advance designed to stop them dipping into a costly bank overdraft.

Meanwhile, Cleo says it has grown revenue by 400 percent in the last twelve months, and Hussey-Yeo tells me the company is now doing $10 million-plus ARR. In a further nod towards stronger unit economics, the cost to acquire a user is now less than $2 with the vast majority of users acquired organically.

“So we’re definitely not in growth at all costs mode,” he says. “We’ve worked hard over the last 12 months to bring our payback period comfortably under 12 months which is an incredibly rare feat at scale for fintech”.

One interesting aspect of Cleo’s mission and the strong “personality” its chatbot exhibits, is that the problem space the company is tackling is potentially based on behavioural science as much as it is data science. Hussey-Yeo doesn’t disagree.

“This is where the idea of a conversational interface came from,” he says. “I realised you could break the complexity down into a language anyone could engage with, and I mean actually look forward to engaging with it, to ultimately change their behaviour.

“Today we have an outstanding machine learning department but just as importantly is the behavioural researchers and writers at Cleo. We know this is the combination that makes Cleo special and, I hope, will eventually lead to us being the financial advisor for a billion people”.