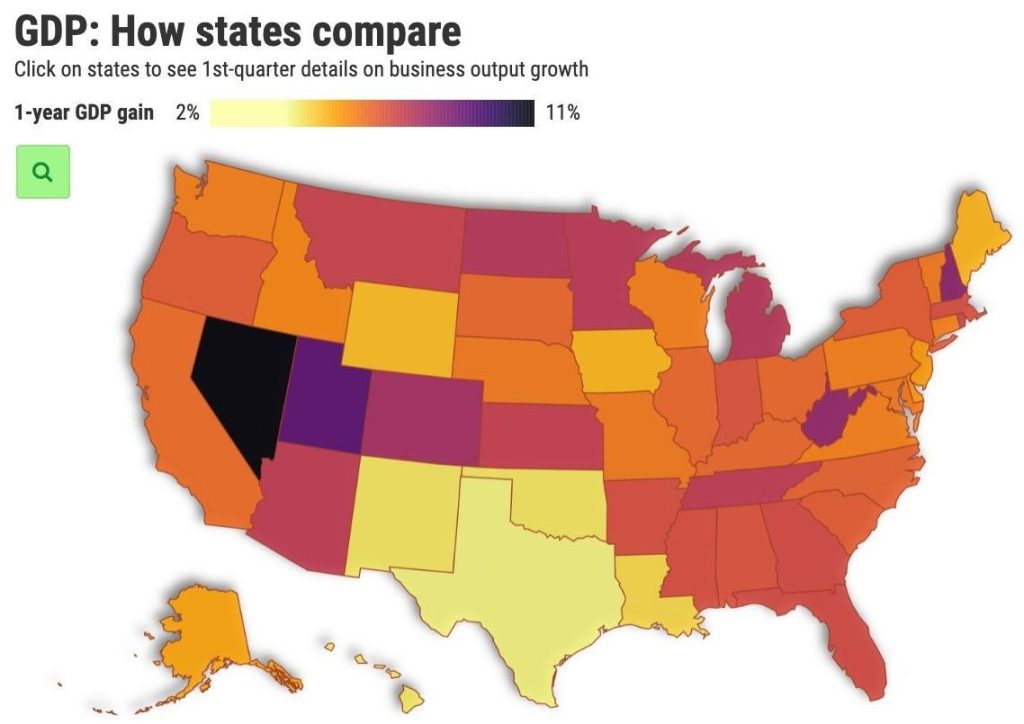

Texas had the nation’s second-worst economy at the start of 2021.

I mention that stat — courtesy of the first quarter’s gross domestic product report — so we could collectively imagine that was California and how critics would crow about the state’s looming demise.

To be honest, it’s also fun to toss a barb at the Lone Star State, a worthy competitor.

For the record, California’s business output grew at a 6.3% annual rate in the year’s first three months — a mid-range performance as the state slowly reopened its economy. It ranked No. 29 among the states and was a smidgen below the nation’s 6.4% GDP growth.

The No. 1 state was tourism-dependent Nevada, with a 10.9% growth rate as it welcomed back visitors. Worst? The District of Columbia saw a 2.9% growth amid a wild presidential transition. Texas, by the way, had 4.3% growth.

Now, no single quarterly economic benchmark paints a perfectly proper portrait. But this data — a broad measure of business output — gives significant hints as to why California’s economy didn’t collapse under pandemic-related limitations.

My trusty spreadsheet dug up California industry niches that bested peers in other states and found some laggards, too. Bottom line: California excelled at certain needs created by the pandemic era. Think technology, real estate and white-collar work.

When I ranked 22 economic niches that comprise GDP, California’s best industry was information. It produced the third-biggest contribution to a state’s output growth. Is that any surprise?

California practically invented the tools powering remote work and schooling. The best information performer was another tech hub, Washington state. Worst? Hawaii. Oh, and Texas? A commendable No. 11.

California did well with another white-collar niche, too. Professional services ranked No. 8. The industry that helps businesses operate — accountants, attorneys, architects, etc. — thrived in the pandemic era. Best? District of Columbia. Worst? Mississippi. Texas? No. 19.

And there is perhaps only one other sector as hot as tech: California’s real estate niche was fourth-best among the states. Low interest rates and pandemic fears ballooned demand for more living spaces. Best? Nevada. Worst? South Dakota. Texas? No. 25.

Hot properties require even more property — not to mention lots of road work. California’s construction growth ranked No. 12. Best? North Dakota. Worst? Wyoming. Texas? No. 21.

California was fortunate that the nation’s hottest industries were also big performers in the state’s economy. Combined, the four outperforming niches cited above equaled 60% of the state’s first-quarter economic growth.

On the bottom

Conversely, California’s industry laggards represented a more modest share of the economy. The bottom four niches combined cut overall state growth by just 7%.

Tied for California’s worst niche was agriculture, 49th among the states. Farmers have been hurting because the pandemic made harvests tricky and upset the supply chain. The best state for agriculture was Montana. Worst? Idaho. Texas? No. 36.

Also getting a No. 49 ranking in California was government spending. Fiscal stress tied to lower sales tax collections trimmed municipal budgets and staffing. Best? New Hampshire. Worst? Hawaii. Texas? No. 23.

The plight of California’s hotels and restaurants drew lots of headlines and a No. 47 performance among the states. These “fun” businesses continue to suffer due to slow-to-end mandates and a general reluctance to travel. Best? Nevada. Worst? Oregon. Texas? No. 38.

And the state’s finance niche ranked No 39. January’s low point for many interest rates is cooling the lending business. Best state? Delaware. Worst? West Virginia. Texas? No. 10.

Rest of the pack

Here’s how other California economic niches performed in the first quarter, ranked by their relative contribution to GDP growth vs. other states …

No. 17 nationally was healthcare and social services. The made-for-pandemic industry fared well. Best? Idaho. Worst? North Dakota. Texas? Tied with California for 17th best.

19. Administration: A move back to office work helps support crews (janitors to clerks to guards). Best? New Hampshire. Worst? North Dakota. Texas? No. 8.

19. Other services: Reopening is an opportunity those caring for cars, hair, pets, etc. Best? Nevada. Worst? District of Columbia. Texas? No. 12.

20. Retail: In-store shopping isn’t dead … it’s just changing a lot. Best? Nevada. Worst? District of Columbia. Texas? No. 24.

22. Entertainment/recreation: Return to “going out” is boost for “fun” attractions. Best? Nevada. Worst? Iowa. Texas? No. 35.

25. Transportation/warehousing: State’s logistics expertise hummed along. Best? Alaska. Worst? Wyoming. Texas? No. 10.

28. Mining/oil: Sometimes, it helps not to have an energy industry. Best? Wyoming. Worst? Texas.

28. Wholesaling: Growth in online shopping boosts the middle of the supply chain. Best? Colorado. Worst? North Dakota. Texas? No. 35.

29. Durable-goods making: Strict mandates made factory work challenging. Best? Indiana. Worst? Washington. Texas? No. 25.

30. Nondurable-goods making: Farming woes hurt food processing. “Stay at home” hit clothing makers. Best? Alabama and Alaska. Worst? Texas.

30. Management: Work from home wasn’t ideal for consultants, etc. Best? New Jersey. Worst? Wyoming. Texas? No. 30.

33. Utilities: Good news: The lights stayed on. Best? Arizona. Worst? Texas.

37. Educational services: “Stay at home” chilled private learning, too. Best? Rhode Island. Worst? Oklahoma. Texas? No. 15.

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com