“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: There’s lots of heated house hunting going on in rural, more affordable parts of California. But it’s not a universal trend.

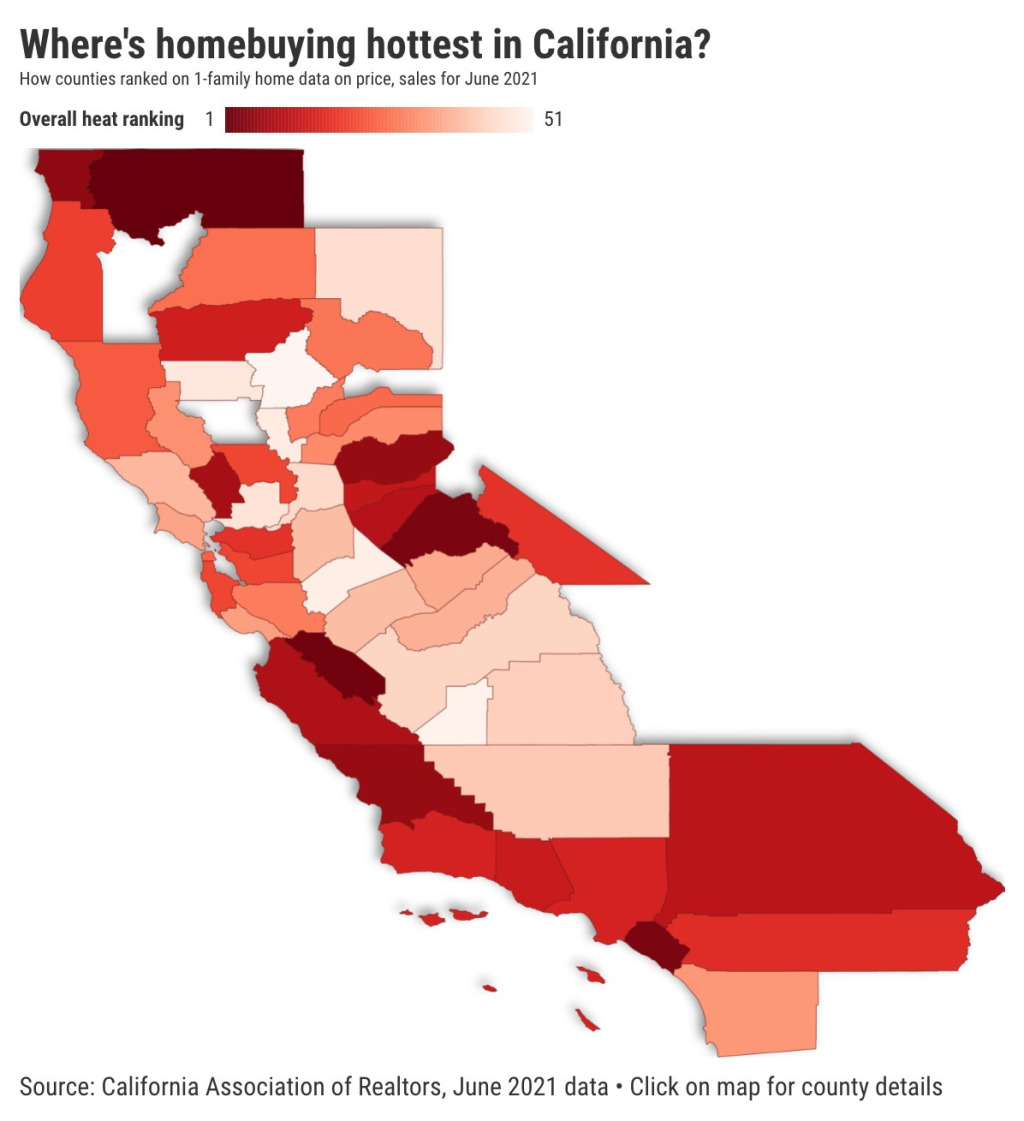

Source: I filled my trusty spreadsheet with California Association of Realtors data on June’s closed transactions of existing, single-family houses, making an educated guess at where the state’s homebuying was hottest.

The Trend

There’s no easy answer to where it’s hottest — especially in the pandemic era. My formula was to rank the 51 counties tracked by CAR using four factors: one-year change in median selling price, sales activity, listings-to-sales ratio (housing supply) and time on the market (selling speed).

Next, I compiled a collective ranking of these four benchmarks to see where homebuying is hottest — and in 2021’s crazy market, where it’s less hot. Now one month isn’t a trend, and keep in mind we’re comparing today’s buying binge with a coronavirus-iced economy of June 2020.

Still, the highest average rankings …

1. Siskiyou County: The top spot (which borders Oregon) had a $300,000 median in June; a 41% one-year price gain; 74% more sales; 57% smaller supply; and home spending 81% fewer days on market.

2. San Benito County: This NorCal community had a $794,690 median; 36% price gain; 45% sales increase; 47% supply dip; 84% fewer days on market.

3. Orange County: $1,138,000 median; 31% price gain; 62% sales increase; 57% supply dip; 65% fewer days on market.

3. Tuolumne County: It borders Yosemite and had a $413,820 median; 36% price gain; 48% sales increase; 46% supply dip; 68% fewer days on market.

At the bottom we also find mostly Northern California locations, noting that “cool” these days is “sizzling” in a normal market …

51: Butte County: $438,000 median; 12% price gain; 3% sales increase; 10% supply dip; 57% fewer days on market.

50: Kings County: $295,000 median; 11% price gain; 14% sales increase; 29% supply dip; 38% fewer days on market.

49: Stanislaus County: $430,000 median; 21% price gain; 5% sales drop; 0% supply dip; 50% fewer days on market.

48: Sutter County: $395,000 median; 16% price gain; 7% sales drop; 41% supply hike; 63% fewer days on market.

The Dissection

Some hints of a north-south divide show up when you look at our bigger markets …

11: San Bernardino County: $435,000 median; 34% price gain; 17% sales increase; 32% supply dip; 76% fewer days on market.

15: Los Angeles County: $796,120 median; 29% price gain; 42% sales increase; 40% supply dip; 53% fewer days on market.

17: Riverside County: $575,000 median; 28% price gain; 17% sales increase; 37% supply dip; 70% fewer days on market.

21: Alameda County: $1,300,000 median; 33% price gain; 45% sales increase; 32% supply dip; 38% fewer days on market.

25: San Francisco County: $1,950,000 median; 8% price gain; 87% sales increase; 52% supply dip; 37% fewer days on market.

29: Santa Clara County: $1,750,000 median; 27% price gain; 47% sales increase; 38% supply dip; 27% fewer days on market.

33: San Diego County: No. 33 — $865,000 median; 28% price gain; 29% sales increase; 32% supply dip; 50% fewer days on market.

44: Sacramento County: No. 44 — $525,000 median; 26% price gain; 13% sales increase; 26% supply dip; 40% fewer days on market.

And considering all the talk about inland migration, here’s a collective look at median results for the 15 California counties on the Pacific vs. the rest of the state. Homebuying in those pricier, ocean-close towns, at a minimum, have rebounded nicely …

Price: $862,500 coastal vs. $615,852 elsewhere.

Price gain: 29% coastal vs. 24% elsewhere.

Sales increase: 35% coastal vs. 20% elsewhere.

Supply drop: 45% coastal vs. 32% elsewhere.

Days on market decline: 50% coastal vs. 56% elsewhere.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FOUR BUBBLES!

Curious trends give us a dash of comfort.

Let me say, I’m taking a more hopeful view after seeing much of California’s wildest action is happening in less-populated counties. These markets were unlikely to easily absorb today’s wave of heated homebuying desires. Perhaps you could explain these booms as a passionate discovery of hidden gems.

Plus, surprising strength to the south and the coastline suggests that fears that some parts of California might be hit by a mass exodus — inland, or to other states — were exaggerated.

But when the Realtors’ statewide price benchmark jumps 31% in a year, you have to worry that something’s seriously out of whack.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com