The “R-word” is back in the news.

The rising cost of living coupled with a dip in the nation’s business output, declining stock prices and geopolitical worries suggest the economy is facing some real challenges.

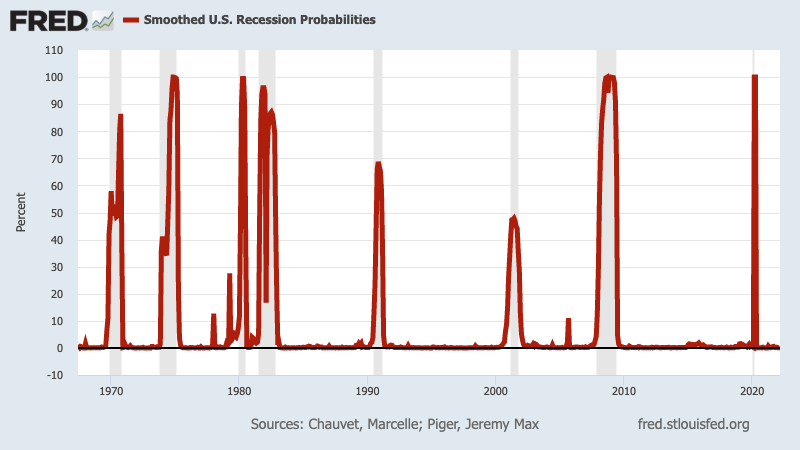

Personally, I wonder if this economic angst is more a symptom of this age of weaponized anxiety. There’s less than a 1% chance of a recession, according to a probability index by an Oregon professor who tracks economic variables. His work is charted above!

However, I’ll note that recent surveys show 28% of economists (Wall Street Journal) and 81% of consumers (CNBC) think an upcoming recession is a solid possibility.

Instead of me explaining the proper level of recessionary worry, I’ll let you decide on the likelihood of a recession.

What follows are 10 economic forces with recession-causing powers. All you have to do is decide if these factors are a big worry today or not. You can add up your biggest concerns and check my formula below for your forecast. Or, you can take the online version of this forecast tool by going to https://bit.ly/recessionforecast!

And if this scorecard says you possess plenty of big worries, then prepare yourself for the possibility of a major economic pullback.

1. Infectious inflation

How financially painful are today’s rising prices and will inflation morph from just a budgetary headache into a major monetary impediment? Forget the cost to your wallet. Inflation can dramatically change how consumers and corporations think about money — and it’s not usually in a positive way.

Worry? Will the worst bout of inflation in four decades make people too cautious about how they spend and invest?

2. Shopping stoppage

Collectively, the economy is about how much consumers and companies spend. Let’s face it, many folks and businesses today are flush with cash. And much of the recent economic strength can be tied to putting those spare dollars to work. That might not last for eternity.

Worry? Will the boom-time mentalities change, making savings vs. spending the next hot fashion?

3. Fed foibles

There is probably too much faith put in the nation’s central bank — the Federal Reserve — and its abilities to effectively manage economic challenges. History tells us the Fed’s batting average isn’t all that good. And its delayed reaction to current challenges isn’t a good start to fixing this cycle’s problems.

Worry? Will the Fed be able to handle today’s recessionary forces?

4. Bubbling business

Who doesn’t love inflation when it comes to the investments they own — from stocks to houses to even cryptocurrencies? However, falling asset values — from modest corrections or massive crashes — make for skittish consumers and companies. Not only do capital gains disappear in eras of depreciation but psyches get damaged. Remember when the last bubble burst?

Worry? Will crumbling investment values become are a big economic risk?

5. Investors’ overindulgence

Let’s not forget that the economy needs constant investment to keep running. That cash flow has been generous in recent years as investors have been lured to risk-taking thanks to a streak of money-making years and paltry yields on “safe” bets. But when investors prune these sources of business-building capital, economic opportunities quickly dry up.

Worry? Will investors of all sorts get spooked and start to play it safer?

6. Confidence games

One of the economy’s secret sauces is hope – from consumers seeing better days ahead to corporations betting profits are on the upswing. But when confidence is broken, the business climate can change quickly.

Worry? Will economic confidence soon get shattered?

7. Help wanted

It’s been a worker’s market. What if bosses cured the shortage of workers by slowing the hiring pace? The economy runs on workers, and when bosses see a sour outlook, staffing requirements are trimmed. The impact of lost paychecks isn’t just on the jobless. It can boost the supply of job seekers and cut wages hikes for all, as competition for positions increases.

Worry? Will widespread layoffs be the next big thing?

8. Silent struggles

Lost in the swift recovery from the pandemic recession is the fact that not every consumer or company has fully healed, economically speaking. This struggling group won’t easily handle any future downturn. Plus, it’s pretty apparent that future government assistance — from cash to debt relief to low interest rates — will be at best, very limited.

Worry? Will we find far more people and businesses on the brink of a financial flop?

9. Virus variables

The pandemic is a big economic wildcard. We learned in the past two years-plus that the problems are greater than health and medical costs. It’s also the reactions by the public and policymakers to the ups and downs of coronavirus.

Worry? Will a resurgence of the virus become another major economic hurdle?

10. Surprise! Surprise!

How resilient is today’s business climate? History tells us that it often takes the unexpected twist to tip a shaky economy into a full recession. It can be crashing asset values, changing geopolitical tensions or a major failure of a business institution or an entire industry.

Worry? Will one surprising mistake nudge the economy into a huge turndown?

Bottom line

How many of these 10 worries do you consider seriously huge concerns?

My scorecard says five — .inflation, Fed, bubbles, investors, struggle. Divide by 10 and I’m at 50% chance of a recession soon!

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com