“Memory Lane” takes a stroll through financial history because the economy has a funny habit of repeating itself.

Buzz: Mortgage rates suffered their largest one-week jump since 1987.

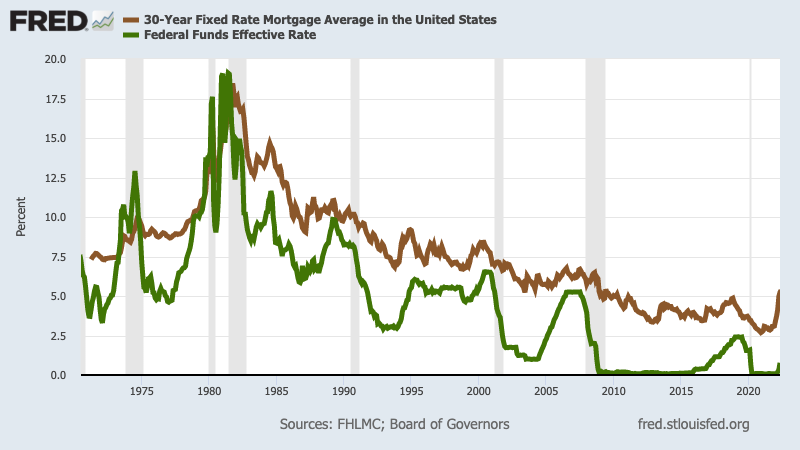

Source: The average 30-year fixed-rate mortgage from a survey by Freddie Mac.

Numbers: Rates soared to 5.78% on June 16, up 0.55 percentage points from 5.23% seven days earlier. In April 1987, rates skyrocketed 0.84 points in a week, jumping to 10.27% from 9.43%.

How long ago?

Let’s jar your memory …

1987 news: The Iran-Contra scandal gripped U.S. politics, Iraqi missiles struck the USS Stark amid the Iraq-Iran war, and televangelist Jim Bakker and US Sen. Gary Hart are both caught in infidelity scandals. Locally, there was the Rodney King beating and the Whittier Narrows earthquake rattled the San Gabriel Valley.

1987 culture: Beverly Hills Cop II was tops at the box office and “Livin’ on a Prayer” by Bon Jovi was No. 1 on the charts. The first Panera Bread opened. The Los Angeles Lakers won the NBA championship.

The backstory

In 1986, a massive federal tax card pushed by then-President Ronald Reagan put lots of cash in the checkbooks of Americans.

At the same time, the Fed had been undo its high-rate policies that knocked down the inflation rate — and stalled the economy.

The Fed Funds rate the central bank controls had fallen under 6% in the fall of 1986 after approaching 20% earlier in the decade. It was a 10-year low for this key rate.

Mortgage rates acted as you’d expect, falling to 9% in February 1987 — the lowest in a decade. That certainly explains the 7% price gains for California homes in 1986.

And by April 1987, the broad economy had recovered from the pain of the early 1980s. U.S. unemployment fell to 6.3%, the lowest in seven years.

The stock market also noticed, surging 24% in the year ended in 1987‘s first quarter — the fifth consecutive quarter with 20%-plus year-over-year gains.

The result

Of course, all that upbeat news in 1987 created one big problem: inflation.

The Consumer Price Index was rising at 1.1% when 1986 ended, the lowest inflation in two decades. But by April 1987, inflation rose to a 4% annual rate.

The Fed acted swiftly. From October 1986 to October 1987 the Fed Funds rate was pushed from 5.8% to 7.2%. Mortgages followed, rising above 11% by October 1987 — and never stayed below 10% until 1991.

Oh, and in October 1987, stocks lost 20% in a single trading session — the “Black Monday” crash.

And home prices? In California, they rose 10.5% in 1987, 16% in 1988 and 21% in 1989. (Then, they fell for the next six years!)

History lesson?

Just like 2022, the 1987 story reminds us that all good things tend to end.

That’s not “gloom and doom” thinking, it’s a realistic assumption that human nature tends to go overboard when wallets are flush — and then reality pops.

One reason for such pragmatism is the Fed’s odd role of being the adult in the room.

When times are economically slow, the Fed’s like a bartender — liberally spiking the economy with its stimulant of choice, cheap money.

But then when things get a bit frothy, the Fed turns into the party pooper — acting like a responsible tavern owner, it puts a chill on the economic fun with its “last call” action of hiking those same rates.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com