“Crash, correction or chill” looks at economic and real estate trends that offer hints about the depth of housing’s troubles.

Buzz: California mortgage-making took a record tumble this summer as soaring interest rates made most loans unaffordable.

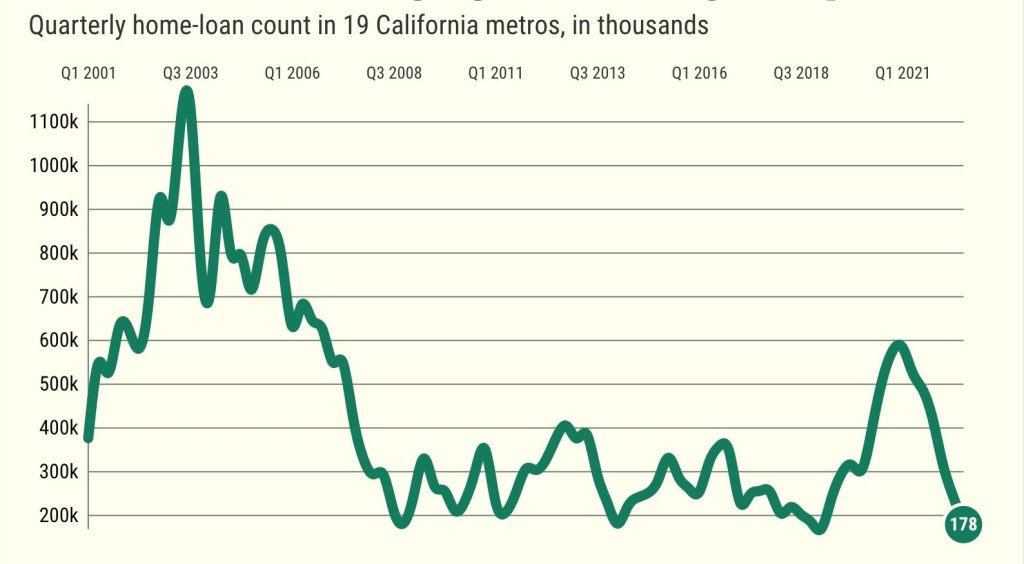

Source: My trusty spreadsheet analyzed third-quarter mortgage lending trends compiled by Attom. These stats, dating to 2000, look at loan-making in 210 metro areas nationwide – including 19 regions in California.

Topline

Californians in 19 metro areas took out 177,566 mortgages from July through September.

That’s the second-slowest slowest three months of the century. It’s also a stunning 63% nosedive from the year-ago period, making this the biggest 12-month drop on record.

Yes, this home-loan crater is deeper than anything we witnessed during the bubble-bursting housing meltdown of the mid-2000s.

How did this happen?

The Federal Reserve ballooned rates to battle surging inflation. In the past 12 months, the average 30-year loan jumped to 6.9% from 3.1%, according to Freddie Mac.

Skyrocketing rates slashed a house hunter’s potential “borrowing” power by 35% in a year and topped the 33% decline of 1980, another high inflation era when rates went to 16.3% from 10.5%.

So this summer, mortgages made to buy a home fell by 53% from a year ago. And homeowners refinanced 82% fewer loans.

Strikingly, owners did take out 74% more home equity loans. This tactic has become the preferred way to pull cash from a house without losing the great rates on an older mortgage.

By the way, this is not some California-only trend. Every U.S. metro tracked by Attom saw fewer mortgage deals cut in the past year.

The nation, minus the California metros, had 1.8 million mortgages made this summer – a 44% drop over 12 months, also the largest decline on record. There were 30% fewer purchase loans, and 66% fewer refis but 45% more home equity loans.

Crash, correction or chill?

Crash: If you make mortgages for a living, this is a huge disaster. No loans. No paychecks.

Mortgage broker Jeff Lazerson, a Southern California News Group contributor, recently wrote he laid off two-thirds of his staff: “Business has all but stopped for mortgage lenders. And, yes, it’s much worse than the mortgage volume collapse I remember from the Great Recession.”

Correction: For the broad housing market, it’s part of a return to normalcy from a boom fueled by the Fed’s cheap money policies of the early pandemic era. This year’s rate surge is designed to slow the overall economy as well as housing.

Chill: Speaking to the big picture, this dramatically slowed lending is a relatively minor annoyance.

The loss of home sales is an economic minus. But, remember, thanks to 30-year, fixed-rate mortgages, the Fed’s gift to any owner who refinanced in recent years remains in place.

That extra cash from shrunken mortgage payments is still being spent. It’s one slice of the overheated, inflation-filled economy. And the improved household cash flow can be a financial cushion against any significant downturn.

The unknown

Lenders have been very conservative about who gets mortgages in this cycle. So it’s a reasonable bet the surge in home-equity lending is being done prudently. (Fingers crossed!)

But if the uptick in home-equity loans is due to the financial strain of borrowers, that’s a worrisome pattern for the broad economic picture.

Details

How mortgage-making slows in some of California’s largest housing markets, ranked by the size of the one-year drop in lending through the summer …

San Jose: 8,114 mortgages made in the third quarter, down 71% (the No. 1 dip among all U.S. metros). That came from 60% fewer purchase loans closed, 89% fewer refinance deals, but 46% more home-equity loans.

San Francisco: 22,048 mortgages, down 67% (No. 5 of the 210) – 56% fewer purchase loans, 86% less refis, but 35% more equity loans.

Ventura County: 4,212 mortgages, down 65% (No. 8) – 54% fewer purchase loans, 86% fewer refis, but 85% more equity loans.

San Diego: 16,835 mortgages, down 65% (No. 9) – 56% fewer purchase loans, 84% fewer refis, but 79% more equity loans.

Los Angeles-Orange County: 51,431 mortgages, down 64% (No. 12) – 55% fewer purchase loans, 83% fewer refis, but 82% more equity loans.

Sacramento: 15,422 mortgages, down 62% (No. 18) – 49% fewer purchase loans, 83% fewer refis, but 94% more equity loans.

Inland Empire: 28,247 mortgages, down 60% (No. 22) – 49% fewer purchase loans, 78% fewer refis, but 127% more equity loans.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com