It wasn’t a very happy holiday season for California’s shoppers.

Sales tax collection stats for 2022’s final quarter showed consumers were cautious about how they spent money.

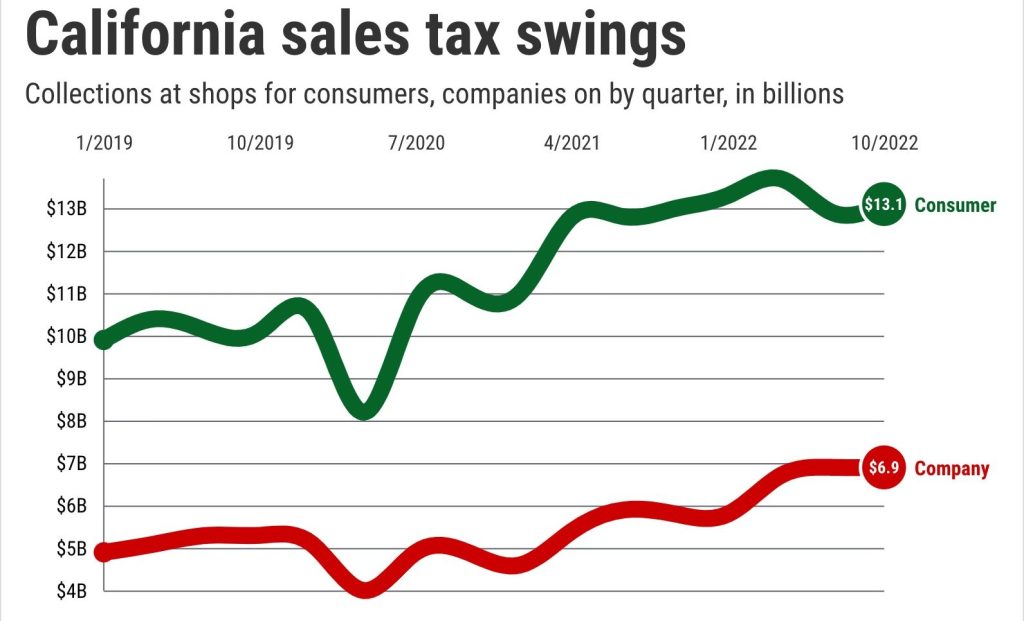

California’s sales tax collectors say they took in $20 billion on purchases of all taxable goods and services in the fourth quarter, up 7% in a year. Tax collections are a fairly good measure of what’s being bought across the state, though they do miss a key slice of spending – services from personal care to entertainment that isn’t taxed.

The year-end growth was a slight improvement over the third quarter’s 6%. So what’s the problem?

For starters, inflation ran 7% in the past year. So California spending barely kept up with rising prices.

And my trusty spreadsheet found the modest overall growth masks a trouble spot – consumers. Any growth, no less increases above inflation, is hard to find in the tax collection categories heavily tied to what individuals buy.

Consumer-oriented sales taxes added up to $13.1 billion in the fourth quarter – up a sub-par 1% from a year earlier. That equals the 1% growth pace of 2022’s third quarter.

Conversely, as consumers were conservatively spending, companies were still in a buying mood. Taxes collected for various business materials and services were $6.9 billion in the fourth quarter – up 19% in a year after 18% gains in the previous quarter.

Lots of worries

Consumers’ year-end shopping chill makes some sense, considering all the conflicting economic signals being thrown at them.

Shoppers can cheer a strong overall jobs market but likely are worrying about the meaning of a year-end filled with news of big layoffs, notably in the tech industry. Big pay raises also are being gobbled up by high inflation. And there’s the suddenly chilled housing market.

Also, the return of everyday life to a somewhat “new normal” – post Covid 19 – certainly alters spending habits.

Plus, year-end 2022’s diminished consumer spending could be a reality check by shoppers after a pandemic-era buying binge.

The fourth quarter’s tax collections were 29% higher than 2019’s fourth quarter, just before the coronavirus struck. That growth easily outpaces inflation’s 16% run-up over three years.

Where’s the chill?

Let’s look inside the consumer categories to see what’s hot – and what’s not.

For starters, the shopping center was out for the holidays. Going online remains the preferred option.

Those “nonstore retailers” collected $1.45 billion in sales taxes in the fourth quarter, up 7% for the year. Meanwhile, “general merchandise stores” – mainly old-school department stores and warehouse clubs – took in $1.25 billion, a 4% drop in a year.

Now let’s consider the specialty merchants found at the mall.

Stores selling sporting goods, musical instruments and books dropped 7% to $244 million. Perhaps there’s less time for play as life returns to a pre-pandemic pace.

Telecommunications taxes were down 4% to $168 million. Heavy discounting by cell-service providers is a culprit.

Health and personal care stores dropped 2% to $391 million. Reduced virus fears cut the need for health products.

Clothing stores were flat at $1.1 billion. The pandemic life gyrations – where you worked or schooled – has run its course for apparel.

The only gain was in “miscellaneous” – retailers of items like office and pet supplies – which gained 2% to $583 million. I guess Fido or Fluffy still need food.

Not just the mall

The sharply sluggish housing market, a dramatic shift from 2021’s feeding frenzy, translated to fewer home-related purchases.

Not only are shoppers pinching pennies, but relocations – whether for ownership or rental – nudges people to buy household goods.

Building materials stores collected $1.11 billion in taxes in the fourth quarter, down 3% in a year. Furniture and home furnishings took in $345 million, down 6%. And electronics and appliance stores were at $409 million, off 5%.

Improved supply conditions also altered transportation spending.

Gas station taxes fell 4% to $658 million. Pump prices dropped last year. And vehicle sales taxes increased just 2% to $2.3 billion. New car dealers have things to sell while used car prices are diving.

Or look at the supermarket. Tax collections at food and beverage were flat at $769 million. Remember, most groceries aren’t taxed – but this, too, signals a tight-fisted consumer.

However, there was one slice of holiday cheer in the tax report.

Looks like the hot seasonal treat was dining out. Restaurants collected $2.34 billion in the fourth quarter, up 8% for the year.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com