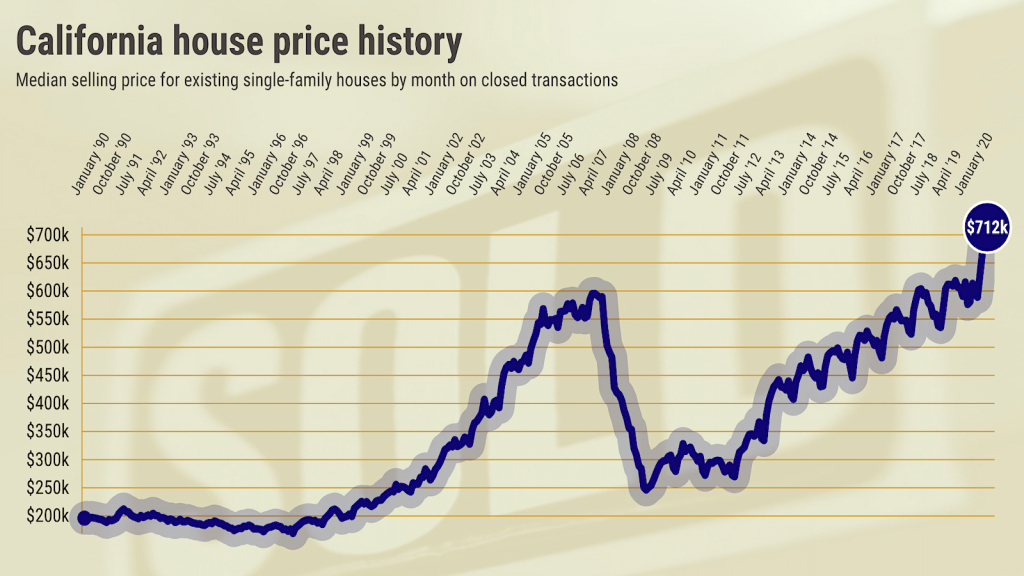

“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: California house prices hit their fourth consecutive record high after a 17.6% year-over-year gain.

Source: California Association of Realtors

The Trend

The median sales price for an existing single-family house in California was $712,430 in September vs. $605,680 a year earlier, creating the largest percentage-point jump since 2014. A buying frenzy fueled the price gains, with houses selling at a 489,590-a-year pace — up 21% in a year to the fastest pace since February 2009.

The Dissection

Housing’s rebound from a springtime coronavirus-related dip has been powered by historically low mortgage rates and the pandemic’s push to own larger living spaces.

Note these September statewide trends from the Realtor report …

There’s nothing to buy: The Realtors’ unsold inventory index hit its lowest supply since November 2004. The number of listings priced under $1 million is down 56% in a year

Sales are swift: Typical time from listing to escrow? A record-low 11 days in September, down from 24 a year ago.

Buyers paying up: The sales-price-to-list-price ratio was 100% in September — in theory, no discounting from first listing price — vs. 98.5% a year earlier.

It could be partly a “mix” issue: Homes that sold averaged $321 price per square foot, up 11% in a year. That suggests more expensive homes are selling, creating a large increase in the median price.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … THREE BUBBLES!

Let me simply quote the association’s chief economist Leslie Appleton-Young.

“It’s sounding like a broken record as California home sales and prices continue to outperform expectations. However, with the shortest time on market in recent memory, an alarmingly low supply of homes for sale, and the fastest price growth in six-and-a-half years, the market’s short-term gain can also be its weakness in the longer term as the imbalance of supply and demand could lead to more housing shortages and deeper affordability issues.”

PS: The Realtors’ “most-likely scenario” forecast for 2021 is for 1% price growth and a 3% sales increase.