“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: Home-price gains aren’t what they used to be, although it takes some work to find that trend.

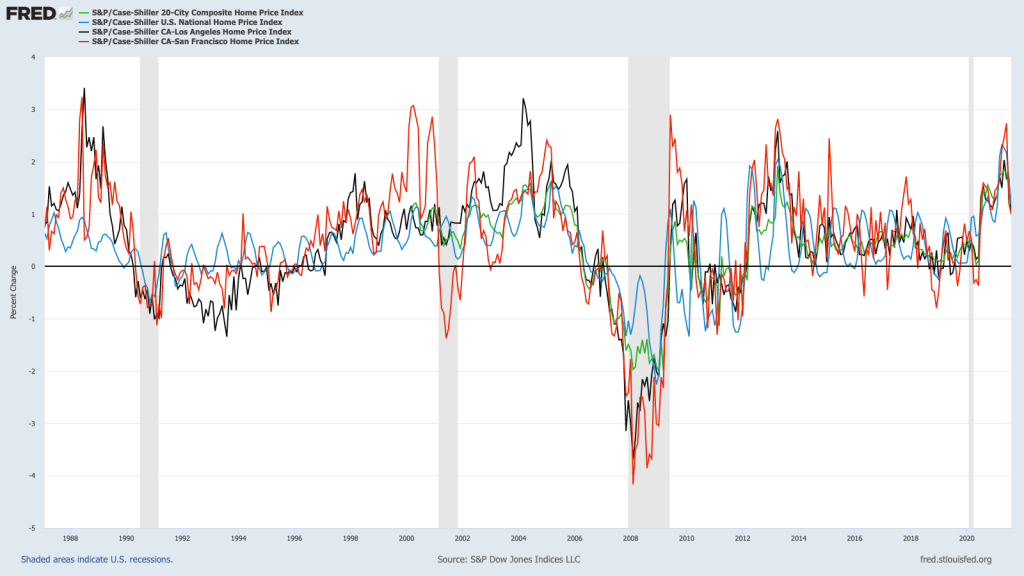

Source: S&P CoreLogic Case-Shiller has released various indexes of residential property values for August.

The Trend

You may not see this in many news headlines, but Case-Shiller reported the smallest monthly gain since July 2020 in its much-discussed 20-city index for August.

The national benchmark was up 1.2% for the month vs. July’s 1.5% increase. And one-month gains shrank in all but two cities.

Homes in Los Angeles and Orange counties appreciated 1% in August, down from 1.7% for July and the smallest one-month gain since June 2020. The Bay Area was up 1% in August, down from 1.2%.

The cooling is found with a longer statistical lens, too.

The 20 U.S. cities saw 19.7% year-over-year gains, down from 20% in July. It was the first slowing for annualized gains after 13 months of growing appreciation rates. Year-long price increases dropped between July and August in 12 of the 20 cities.

L.A.-O.C.’s 18.5% appreciation jump was down from 19.1% in July. And the Bay Area’s 21.2% year-over-year gain in August was down from 21.9%.

So, where were the biggest, eye-catching one-year surges? As it’s been for 27 months, Phoenix was No. 1 among the 20 cities — up 33.3%. No. 2 was San Diego, up 26.2%, and then Tampa at 25.9%.

The Dissection

I’ll let S&P guru Craig J. Lazzara take a shot at explaining all of this.

“We have previously suggested that the strength in the U.S. housing market is being driven in part by a reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes,” he wrote.

“More data will be required to understand whether this demand surge represents an acceleration of purchases that would have occurred anyway over the next several years, or reflects a secular change in locational preferences,” he continued. “August’s data are consistent with either explanation. August data also suggest that the growth in housing prices, while still very strong, may be beginning to decelerate.”

Another view

Remember, the index is a seasonally adjusted, three-month moving average of market conditions. So much of the volatility is smoothed out of the yardstick. Plus, this math means we’re really talking a snapshot of July’s pricing patterns.

Imagine if we looked at stock prices the same way. And months late, too.

You’d now be hearing that the S&P 500-stock index in July averaged a 3% gain that month. Year-over-year? Up 36% for July.

Psst! Stocks have since cooled. The S&P 500’s averaging a monthly loss of 0.3% for October, so far. And annualized profits cooled to 30%.

Also, the National Association of Realtors’s median selling price of an existing U.S. house for September was $352,800 — the third consecutive drop from June’s peak of $362,800, or a 2.8% drop. The median was 13.3% above September 2020 — the smallest year-over-year gain of this year.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … FOUR BUBBLES!

Yes, I know we’re still talking about gains — just smaller ones.

Plus, the inevitable slowing of the wild housing price gains of the pandemic era could be a healthy trend for the real estate industry and the overall economy.

Sadly, every other business outside of real estate loves talking about shopper-friendly trends, if not outright bargains. You know, a “sale” for most merchants. Or remember housing’s “affordability” debates?

But property discounting in any form — even less appreciation — is frequently dismissed by various homebuying gurus.

It’s not that these so-called experts get paid directly or indirectly by home sales, though that’s certainly a conflict. Rather, few real estate folks sell ownership as “shelter” these days. Instead, they pitch profit potential or “generational wealth-building” to house hunters.

So shrinking appreciation (and dare I mention that mortgage rates are at six-month highs) makes for a tougher sale. And that’s why #pricegainsmatter!

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com