Zaver, a Swedish fintech that has built a payments platform to facilitate peer-to-peer trades and more, has picked up just over $1.2 million in seed funding. Backing the burgeoning startup are VC firms Inventure and Inbox Capital, as well as a number of relatively well-established angel investors.

They include Joen Bonnier (partner at Atomico), Tom Dinkelspiel, Pontus Hagnö, Fabian Hielte (owner of Ernström & C:o and a previous investor in Spotify and iZettle), Bo Mattsson (founder of Cint) and Fredrik Österberg (founder of Evolution Gaming).

Aiming to disrupt the market for P2P payment solutions, Zaver is developing a SaaS and accompanying apps to bring together buyers, sellers and merchants with the promise of “secure payments on your terms.” The fintech startup aims to facilitate trades between peers by enabling the use of flexible payment methods such as direct payments, “buy now, pay later” and installments.

To support this, Zaver’s platform claims to embed “intelligent fraud detection” algorithms in tandem with the automatic creation of “verified digital agreements” between transacting parties.

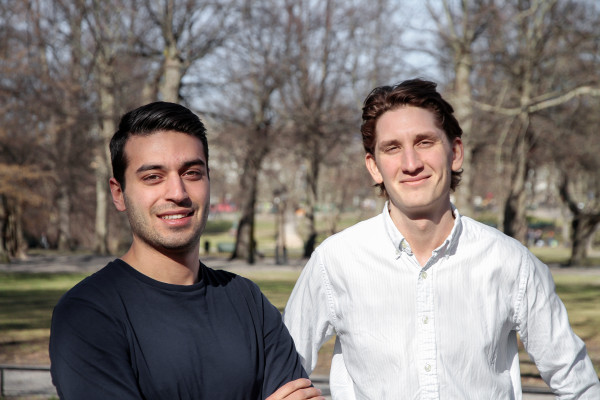

“The Zaver app is the first platform-independent checkout solution for P2P transactions,” says Amir Marandi, who co-founded Zaver alongside Linus Malmén — both former engineering students at KTH Royal Institute of Technology.

“With Zaver’s intelligent fraud prevention, automated and immediate credit decisions and cryptographically signed digital receipts, peers can do safe payments on their own terms with people they really don’t know that well,” he says. “We try to make P2P trades as safe as possible for all parties involved and offer flexible payment options, without compromising on the user experience.”

In addition, Zaver for Business enables merchants to utilise the platform to increase conversion and reduce transaction costs. “Our mission with this product is to reduce the need of a physical card reader,” adds Marandi.

Zaver’s typical user is described as a young student who wants to sell their iPhone on a classified site in a secure way, or a plumber who wants to buy a used VW Golf today and pay later. Meanwhile, the typical customer of Zaver for Business is a company with omni-channel sales, selling products/services online and offline.

“Our main competitors are not the kind of business you might expect,” explains Marandi. “It’s not the banks, but rather upcoming startups wanting to innovate the payment industry. The most direct competitor today I would say is the credit card industry.”

To that end, Zaver makes money from the transaction fees it charges merchants (which it says are up to 70 percent cheaper than traditional payment services), and on interest charged when someone chooses to pay via installments.

Adds Marandi: “Using automated systems for the entire customer journey we are able to offer individualised interest rates at the point of sale. The system automatically chooses an interest rate for you, based on your creditworthiness.”