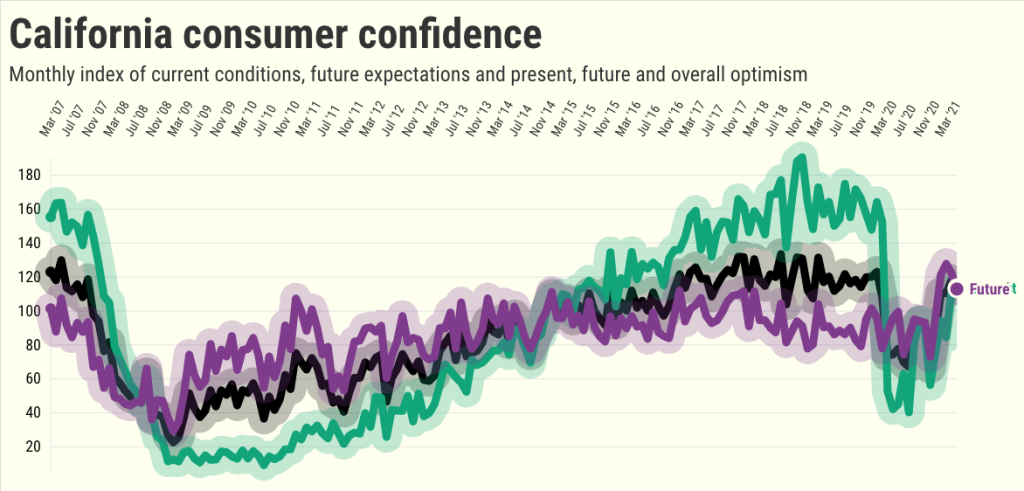

California shoppers lost a touch of confidence this month as their economic outlook soured slightly.

The Conference Board’s polling put its consumer confidence index for California at 113 for May — down from a revised 118 a month earlier, the pandemic era’s high.

Yes, the latest reading is up from a locked-down economy’s 74.1 a year earlier. And California’s confidence averaged 113 in the five years before the pandemic. So we’re on par with the “good ol’ days.”

Cooled confidence comes as the state’s coronavirus woes swiftly declined in May as the number of vaccinated Californians grew. But employment levels rebounded slowly despite the economy’s expanded reopening.

Consider what two measures inside the statewide index tell us about the psyche of shoppers in May.

Consumers upgraded their view of current conditions, scored today’s economy at 113.5 — up from 111.9 a month earlier and above 41.9 a year earlier. Still, this is far from the 141 average seen in 2015-19’s before-COVID-19 economy.

Shoppers dimmed their outlook, though. The future score of 112.7 was less optimistic than the 122.1 in the previous month and the all-time high of 127 in March. This index dates to 2007.

However, this measurement of financial hope is up from 95.6 a year earlier and a 94 average in pre-pandemic 2015-19.

The Conference Board also tracks seven other big states. For the month, overall confidence rose in Florida, Illinois and Pennsylvania. Over 12 months, optimism is up in all seven — those three and Texas, New York, Ohio and Michigan.

Current conditions improved in six of these states — all but New York. Over 12 months, today’s economy is better in all but Michigan.

Expectations rose for the month only in Florida and Pennsylvania. Over 12 months, the future looks brighter in all but Michigan and Ohio.

Nationally, the U.S. consumer confidence index was 117.2 in the month vs. 117.5 a month earlier and up from 85.9 a year ago.

U.S. shoppers’ view of current conditions increased in the month and was higher over 12 months. Meanwhile, consumers’ economic hopes nationwide were worse compared with the previous month and more optimistic than a year earlier.

National outlook for employment: 27.2% of consumers see more jobs six months from now vs. 31.7% a month earlier; and 39.5% a year ago. The 2015-19 average was 17.4%.

As for two major purchases, the national view …

Plans to buy a home within six months? 4.3% this month, the lowest level since 2013. It’s down from 7.1% a month earlier and 6% a year ago. Before COVID-19, this metric averaged 6.1%.

Car purchase plans? 9.1% this month, down from 11.1% a month earlier; 11.3% a year ago; and the 2015-19 average of 12.6%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com