“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

Buzz: California consumers seem a bit antsier than other Americans. But are shoppers not worried enough?

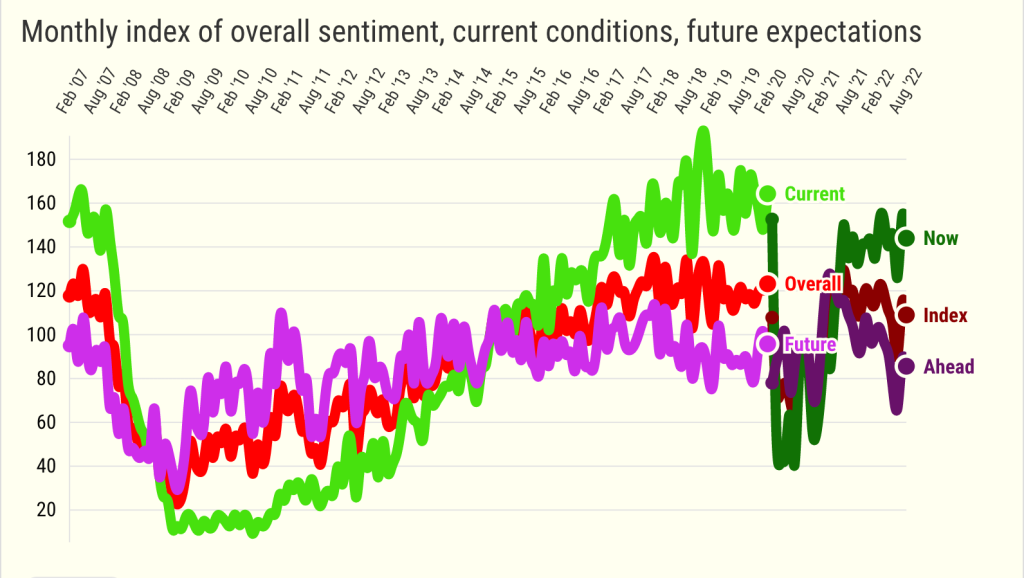

Source: My trusty spreadsheet analyzed The Conference Board’s monthly polling of shoppers for September. The surveys create various consumer confidence indexes, including one for California.

The Trend

All three state measures of optimism fell for the month as the summer ended. But there still are plenty of reasons to worry.

The Federal Reserve is working to chill the economy and sky-high inflation. It’s reasonable to suggest these actions could start a recession.

Adding to that are a sour stock market and a weakening housing market. Plus, interest rates have soared. And toss in plenty of geopolitical tensions to make for even more uneasiness.

So, a drop in California’s overall confidence index wasn’t unexpected. It was 108.7 in September — down from a revised 113.5 a month earlier and down a smidge from 108.8 a year ago.

California consumers’ view of current conditions dipped, too. This gauge of the present financial picture fell to 143.7 from 152.8 a month earlier — but it was above 132.2 a year earlier.

And California shoppers had a dimmed outlook. This measurement of expectations fell to 85.3 from 87.4 the previous month and was down from 93.2 a year earlier.

Elsewhere

Surprisingly, there was a more upbeat view — August-to-September, at least — within the Conference Board’s polling of the nation and seven other states: Texas, New York, Florida, Illinois, Pennsylvania, Ohio and Michigan.

Overall confidence: Six increases among the seven states in a month; two up over the year. Nation: Up 4% for the month; 2% lower over 12 months.

Current conditions: Five increases in a month; four up over the year. Nation: Up 3% for the month; 4% higher over 12 months.

Outlook: Four increases in a month; two up over the year. Nation: Up 6% for the month; 7% lower over 12 months.

Big picture

What’s driving swings in optimism? The Conference Board also asks consumers nationwide about the job market and their plans to make major purchases in the next six months …

More jobs? 17.5% said “yes” — up from 17.1% a month earlier and down from 21.3% a year earlier.

Buy a home? 5.3% said “yes” — down from 5.5% the previous month and unchanged vs. 12 months ago.

Buy a vehicle? 10.6% said “yes” — up from 9.6% a month earlier and up from 9.8% a year earlier.

Major appliance purchase? 49% said “yes” — up from 45% the previous month and up from 46% 12 months ago.

Then there’s the big economic worry: inflation. Americans polled expect the cost of living to be 6% higher in a year, down from 6.1% a month earlier and up from 5.6% a year earlier.

And the stock market? 42% see it lower in 12 months, compared with 38% the previous month and 32% 12 months ago.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … THREE BUBBLES!

The Fed wants to ice the economy so inflation falls dramatically. Ideally, part of that plan is getting shoppers to pull back on spending.

But California consumers didn’t seem overly worried in the latest poll. The rest of the nation showed even less concern.

Does this disconnect mean even more aggressive moves by the Fed to get their message past Wall Street to Main Street?

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com