The “Looking Glass” ponders economic and real estate trends through two distinct lenses: the optimist’s “glass half-full” and the pessimist’s “glass half-empty.”

Buzz: California home prices rebounded 7.6% in March, as recently lower mortgage rates gave house hunters some added buying power.

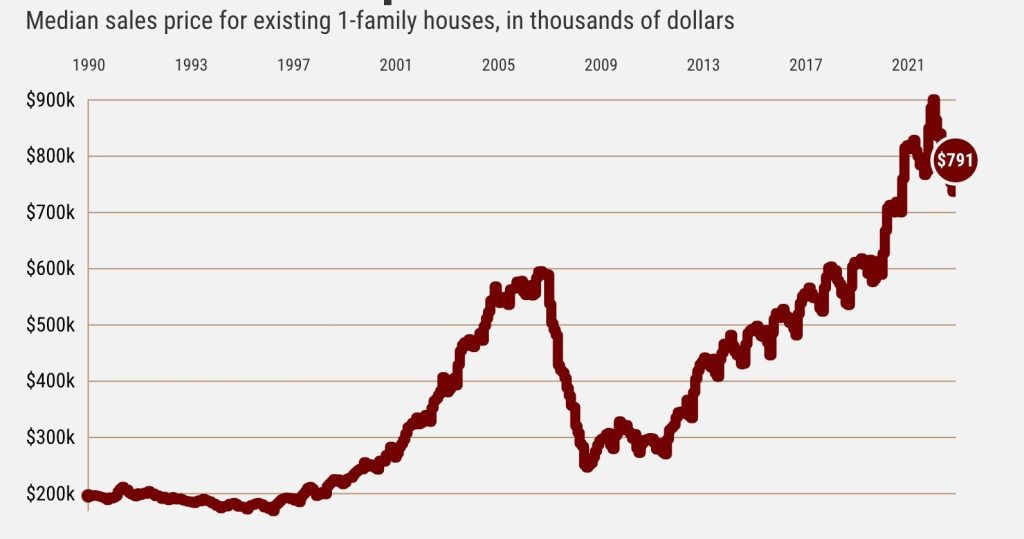

Source: My trusty spreadsheet looked at the monthly sales report from the California Association of Realtors, which tracks closed transactions involving existing single-family houses. The association’s data reach back to 1990.

Debate: Is the housing market finding a bottom after the California bubble burst last year?

Glass half-full

March’s statewide median price was $791,490, up 7.6% from February. This price benchmark had fallen eight out of the previous nine months.

But it’s no miracle turnabout. March is usually a strong buying month. Prices have averaged 5.7% gains in this month since 1990 – and jumped 10% in March 2022.

Consider that March’s price is still off 6.8% in a year, the fifth straight year-over-year decline. And the median is down 12.1% from May 2022’s all-time high of $900,170.

Still, California prices remain 37% higher than in February 2020, the last month before the coronavirus upended the economy.

Glass half-empty

Rising prices are not what the market needs. The California Realtors’ homebuyer affordability index hit a 15-year low in 2022.

The statewide sales pace for March ran at a 281,050 annual rate. This seasonally adjusted number attempts to wring out the calendar’s ups and down on sales counts.

Yet that March sales count was off 1% in a month, a dip suggesting price gains were not due to any significant buying surge.

And sales are off 34% in a year. It was the 21st consecutive year-over-year sales dip.

Bottom Line

History tells us California prices typically rise sharply in March as the traditional house-hunting season gets into gear. So the month’s price gain could be seen as a signal of some normalcy.

And 2023 buyers were likely motivated by recent dips in mortgage rates. The Freddie Mac average 30-year fixed-rate loan went from 6.9% in October to 6.5% in March. Don’t forget, though, rates started 2021 at 2.7%.

Nonetheless, the big story remains sales counts. Despite tales of renewed house-hunting vigor in early 2023, closings remain cold since California’s price bubble burst in 2022’s spring.

Demand remains historically low. In just 22 months since 1990 – that’s 6% – the California sales pace was slower than this March.

Quotable

Jordan Levine, the association’s chief economist: “While home sales continue to hover below the 300,000-unit annualized pace, the market seems to have weathered more aggressive rate hikes and banking failures quite well in the last few weeks. If interest rates stabilize or even improve in the next couple of months, home sales should rise during the spring home-buying season, but tight inventory will prevent a rapid rebound.”

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com