LOS ALTOS — Some high-profile real estate firms have emerged as possible buyers for a choice Los Altos site whose development as a big residential complex has been stalled due to a delinquent loan.

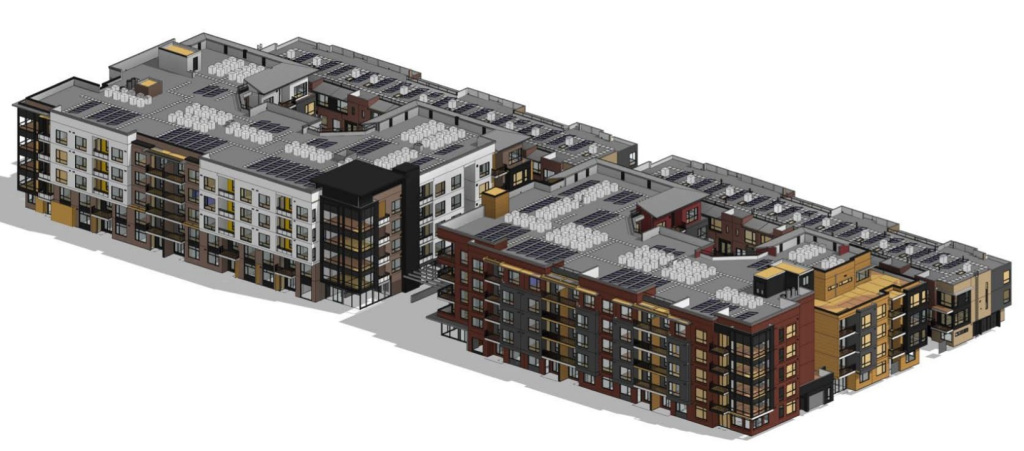

Located at 5150 El Camino Real in Los Altos, the project was deemed to be a way for the posh South Bay city to provide more homes at a time when the Bay Area must fight an uphill battle to meet the demand for housing in the job-rich region.

About 196 residences are slated to be developed on the site.

But the project has stumbled into financial woes triggered by the owner’s default on a $42 million mortgage for the property that Loancore Capital Credit REIT provided in 2018. Dutchints Development, whose principal executive is Vahe Tashjian, paid $48 million in 2018 for the 3.8-acre site, county records show.

The difficulties facing Dutchints Development, which owns the property through affiliate 5150 ECR Group, have become so severe that the project has been shoved into receivership and had been scheduled to be auctioned off this month through a foreclosure proceeding. That scheduled auction has been delayed until at least early fall.

But the prospect of foreclosure alarmed investors in the project because they feared that their stakes would be erased if the property were simply seized by the lender through the auction, according to papers filed with a Santa Clara County Court.

The documents were filed in connection with a civil lawsuit brought by project lender Loancore Capital Credit REIT against the Dutchints Development affiliate that owns the property.

In a foreclosure, if a property is auctioned off, typically the lender seeks only to recoup the loan amount and the proceeds often aren’t enough to cover the equity stakes of any investors in a property.

In the case of the 5150 El Camino Real project, the concerns heightened for investors when a major residential builder, Prometheus Real Estate Group, bought the loan on the property. Loancore Capital Credit REIT sold the note to Prometheus.

By owning the loan, Prometheus could gain an inside track to buy the Los Altos property at a bargain price by seizing the site through a foreclosure.

The latest estimate for the amount due on the loan, including the loan amount, penalties, late fees, and other charges, is $43.6 million.

The investors prevailed on the court to allow a full-fledged effort to offer the property to the open market to determine if a price higher than the loan amount might materialize, according to the court records.

Borelli Investment Co., a San Jose-based firm headed by Ralph Borelli, a veteran broker and developer, has been hired by the court-appointed receiver for the property, to market the 5150 El Camino site.

Multiple interested parties could emerge as possible buyers, according to a declaration on June 23 by Kevin Singer, the receiver in the case.

“We spoke with KB Home, Toll Brothers, and SummerHill Homes, all of whom have expressed an interest in the property,” Singer wrote in the court documents. Sculptor Capital Management, a major investment firm, also has inquired about possibly buying the property, the court records show.

One of the potential buyers even has a price in mind.

“KB Home South Bay has presented an offer of $60 million,” according to the court records.

Superior Court Judge Christopher Rudy agreed with the investors and ordered that a foreclosure couldn’t occur until at least late September of this year.

“KB Home South Bay’s offer is more than sufficient to pay off the $43.6 million balance on the loan and allow for a pool of $16.4 million for distribution to the investors,” the equity investors stated in the court documents.