“Bubble Watch” digs into trends that may indicate economic and/or housing market troubles ahead.

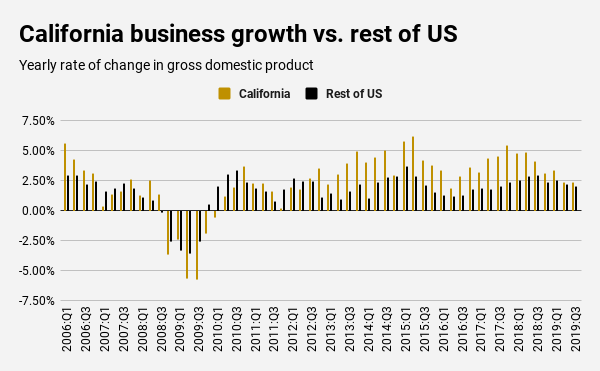

Buzz: California economic growth, as measured by gross domestic product, has been all-but halved this year.

Source: Bureau of Economic Analysis

The Trend

In 2019’s first nine months, California’s business output grew at a 2.3% average annual rate, No. 21 among the states. GDP is the broadest measure of economic activity. That’s a slower pace than for all of 2018 when California’s economy grew at a 4.3% rate, No. 2 nationally between Washington (5.8%) and Nevada (4.2%).

The Dissection

California’s economy has cooled from a U.S. leader to middle-of-the-pack status. Whether that’s part of expected ebbs and flows of the cycle or a signal of trouble ahead, is obviously the big question.

Let’s first look at what my trusty spreadsheet tells us how far California’s economy has come out of the Great Recession. The third quarter’s advance marked the 38th consecutive quarter of positive growth and 29th straight three-month period with economic growth exceeding the rest of the nation.

But we live in a what-did-you-do-for-me-lately world and California’s slowdown equals a 2 percentage-point cooling — 2019’s GDP pace vs. the previous full year. Only four states slipped as much or more this year. Curiously, two of them — Washington and Nevada — had joined California atop the 2018 rankings. And then there was Hawaii and West Virginia.

It seems that the rebound of oil patch industries was one key to gaining high rankings on this state business output scorecard for 2019. Oil-rich Texas was No. 1 for growth in 2019’s first nine months, expanding at a 4.7% pace. And two energy-dependent state economies have seen the biggest growth improvements: Wyoming (up 3.6 points to 3.7%) and Alaska (up 2.1 points to 2.8%).

Another view

The conservative-leaning Rich States/Poor States annual report on state economies, authored in part by high-profile conservative economist Arthur Laffer, ranked California’s long-term economic performance as the nation’s 18th best for 2019. That’s up from No. 20 in 2018 and No. 29 in 2017.

How bubbly?

On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … TWO BUBBLES!

For starters, never underestimate the psychological power of a slowdown. It can change consumer thinking or corporate psyches in a manner that can amplify an otherwise mild cooling trend. And for people who bet on California remaining in fast-growth gear — from worker bees to CEOs to government leaders — a mere business chill can create serious economic distress.

All that said, after this California pullback, the state’s economy remains slightly ahead of what has been only a moderate business-building pace elsewhere.

Ponder that California represents roughly 15% of the entire U.S. economy, measured by GDP since 2016. In 2017, California created 26% of the nation’s economic expansion in the form of GDP dollars and 21% of U.S. growth in 2018. This year, California’s share has fallen to a still above-par 17%.